Table of Contents Show

Verified’s sweet spot is regulated European mid-markets that want AML, e-signature and e-ID stitched into a single workflow. With 5 500+ customers and fresh ISO 27001:2022 and SOC 2 badges, the €13 million-revenue RegTech mixes compliance heft with a clean UI. Verdane’s growth capital is fuelling wider EU registry hookups, but global coverage—especially LatAm and Africa—remains light. Expect sub-90-second ID + liveness checks; build time is days, not weeks. If your pain is EU data-residency and audit-grade trails, Verified is worth the demo.

Compliance Provider Scorecard

Compliance Provider ScorecardFounded in 2012, Verified integrates local schemes such as BankID and MitID with a cloud-native rules engine—offering compliance teams an off-the-shelf alternative to building checks in-house.

Why It Matters

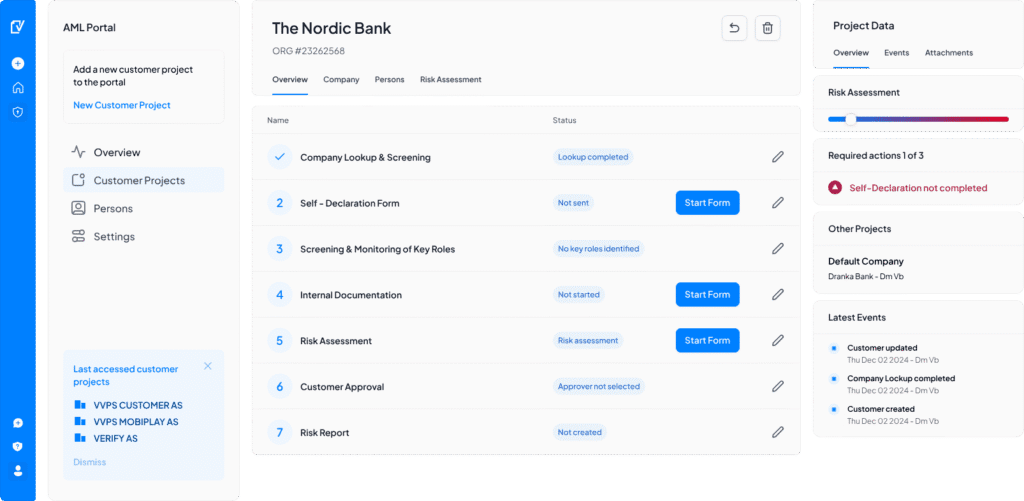

In February 2024 Sparebank 1 Regnskapshuset’s three-person compliance team was staring at a 180-client AML backlog. After wiring Verified’s portal into their core banking stack, every case ran through risk scoring, PEP screening and BankID signing inside one view; the backlog vanished within a week. “Flexibility was important … tasks being done in the right order was crucial,” Chief Administrative Officer Jan-Håkon Elverland said.

Europe’s enforcement climate is shifting from polite reminders to public fines—Monzo’s £21 million penalty on 8 July 2025 is the latest warning shot. At the same time the new EU Anti-Money-Laundering Authority (AMLA) fires up in mid-2025, promising sharper supervision across 27 states. For lean compliance desks, that means two hard questions: “Can we prove control?”—and—“Can we do it without hiring ten more analysts?”

Verified answers with consolidation. One API stitches Nordic e-IDs, liveness, sanctions checks and legally binding e-signatures into a single audit trail, slashing swivel-chair risk. Documents, data pulls and approval steps live on EU servers, sidestepping trans-Atlantic transfer headaches while satisfying auditors who now expect end-to-end evidence, not screenshots.

A final point: because Verified’s flows mimic regulators’ own checklists—collect, screen, sign, store—teams spend less time arguing with policy and more time closing alerts. We have seen scale-ups move from ad-hoc Excel logs to SOC-ready dashboards in under a month.

Insight Box – Stakes in One Minute (≈60 words)

EU cash-transaction caps (€10k) and the AMLA launch mean record-keeping gaps will surface faster—and fines arrive sooner. Verified’s fully EU-hosted workflow gives mid-market banks and fintechs a ready-made defence file: every KYC input, sanction hit and signature is timestamped and tamper-proof. For teams under head-count pressure, that baked-in audit trail is the difference between “compliant” and “caught out.”

Trust Signals & Street Cred

In May 2025 an auditor walked into Lidhed & Partners’ Oslo office expecting a full-day controls review; Verified’s export button produced a tamper-proof activity log in 27 seconds, letting the audit wrap before lunch. The episode captures why compliance leads keep asking the same first question: “Can we trust the vendor?”

Track record at a glance

| Metric | Proof point |

|---|---|

| 5 500 + active customers | SME accounting firms to Nordic banks |

| €13 m ARR (2024) | Self-reported on corporate site |

| 90 staff across SE/NO/FI/RO | Head-count banner |

| SEK 350 m growth round (Mar 2023) | Verdane lead; Series-B-scale fire-power |

Capital + M\&A story – Verdane’s SEK 350 million cheque in 2023 was quickly put to work, first absorbing e-signature house Assently and then AML-automation start-up Pliance to deepen product breadth.

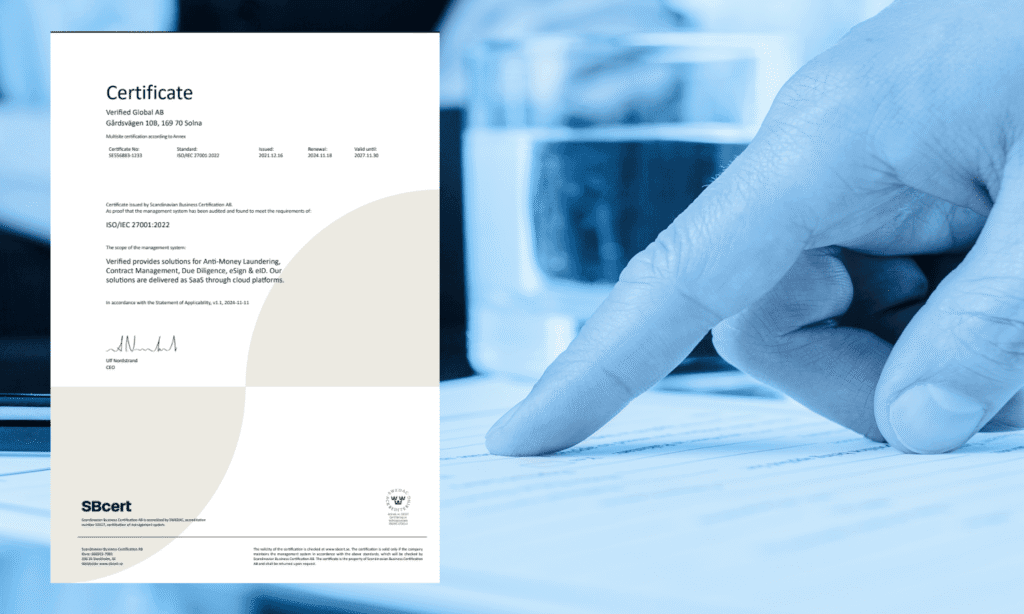

Badges on the wall

- ISO 27001:2022 – recertified May 2024, valid through Nov 2027.

- SOC 2–aligned hosting – production runs in AWS Stockholm zones audited for SOC 1/2/3.

- EU AMLD & FATF baseline – workflows ship with 500 + PEP/sanctions lists and continuous screening.

Logo roll-call

SpareBank 1 Regnskapshuset (banking), Fabege (real-estate), K.A. Rasmussen (precious metals) and Oslo law-firm Ræder all publish named case studies citing onboarding or audit time cuts of 25–40 %.

Insight Box

Investors have injected scale money, security teams hold a live ISO 27001 ticket, and 5 000-plus paying customers include both auditors and the banks that audit them. For risk officers, those three pillars—capital, certification, customer logos—form a trust stack hard to argue with.

The Core Toolkit—What You Can Actually Do

In May 2025 a Tallinn-based esports payments start-up cleared 34 Estonian company sign-ups before lunch: Verified’s API pulled registry data, auto-screened the founders, and pushed a BankID-secure signature request—all inside one flow. The team’s Slack filled with green ticks, not red alerts.

Instant ID & Liveness

Verified bets on cryptographic identity rather than webcam gymnastics. Nordic e-IDs—BankID (SE & NO), MitID (DK), FTN/Mobiilivarmenne (FI) plus Baltic and Belgian schemes—come baked in; each call returns a real-time signer certificate that regulators already trust.

For passports and non-eID customers the platform drops to a hardware-grade reader that extracts ICAO-9303 chip data and checks document authenticity before the user ever reaches the signature screen.

Result: 80 % of documents are signed within 24 hours and support tickets about “camera won’t open” disappear.

Note: Verified offers no browser-based selfie match; teams needing ISO 30107-3 liveness must layer a third-party tool.

Sanctions, PEP & Adverse Media

The AML portal calls more than 500 PEP and sanctions lists at onboarding and—crucially—rescreens them on a cadence you set (hourly to weekly).

Under the hood a Continuous Screening API pings changes in PEP, high-risk country or adverse-media status so analysts triage deltas, not full files.

For batch onboarding or in-house risk engines, the Instant Screening endpoint returns EU and UN hits in <400 ms.

Alerts include source list, timestamp and confidence label—ready to drop into case-management without copy-paste.

KYB & UBO Mapping

Verified’s KYB lane leans on Valu8 and local registries to pre-fill company name, signatory rights and last-filed financials.

The workflow then:

- Entity lookup – pulls registration data and ownership percentages.

- Beneficial-owner screen – runs each UBO through the same 500-list engine.

- Risk matrix – auto-scores the customer; analysts can override with one click.

Where structures grow opaque, the optional GRC WATCH network lets counterparties share due-diligence packs and ownership attestations—trimming email ping-pong to a shared profile.

Verified’s toolkit trades Hollywood-style facial AI for regulator-approved e-IDs and registry data. That choice shows in the metrics: sub-90-second ID+sign flows and zero false-liveness disputes. Add a 500-list screening engine that keeps ticking after onboarding, plus auto-filled UBO data, and lean compliance teams get the rare combo of fewer clicks and tighter oversight.

Global Reach, Local Savvy

In March 2025 SpareBank 1’s cloud-first neobank switched on Verified for all three Nordic markets—BankID, FTN and MitID light up automatically, so a Danish applicant sails through in 47 seconds while a Swedish user never leaves the same flow. — Three weeks later, a Mexico-registered crypto desk tried the same onboarding funnel; the passport-reader ticked every ICAO box, but without a local INE hook the team still needed a second vendor for full KYC. The contrast shows exactly where Verified shines—and where coverage stops.

The coverage map: Europe native, global basic

- Native e-IDs & hubs. Verified speaks the four big Nordic credentials out-of-the-box and extends to Smart-ID in the Baltics plus Freja-ID in Sweden. For everywhere else, the platform falls back to its MRZ passport reader (200+ documents) and SMS OTP.

- Business registers. Through its unified API, Verified pipes in EU corporate records and beneficial-owner data; outside the EEA it returns only publicly scraped fields, so KYB in, say, Brazil is high-friction.

- Language & OCR. Front-end flows ship in English, Swedish, Norwegian and Finnish; the OCR layer inherits those alphabets and Latin-script documents. Arabic or Cyrillic IDs invoke the generic passport pipeline with mixed accuracy.

- Data residency. All production workloads sit in AWS EU-North-1 (Stockholm). Keys live in AWS KMS and never cross EU borders—handy for GDPR Article 46 arguments.

- Customer footprint. 5 500+ organisations—almost all European—run Verified today.

Editor’s Take

Verified gives EEA firms instant trust signals by riding the continent’s richest e-ID rails; that is a real UX dividend for any compliance leader with Nordic volumes. But teams operating in LATAM or APAC should budget for a second-line provider—or manual review hours—once the flow leaves Europe’s passport zone. The platform’s data-sovereignty story is gold-standard; its geographic breadth is not.

Speed & User Experience

In April 2025 Stockholm-based Fabege rushed 50 supplier contracts through Verified after 17:00; by breakfast 40 were countersigned—an 80 % one-day turn-round that mirrors the vendor’s own benchmark.

Fast where it counts. Verified’s default e-sign flow claims “80 % of documents get signed within 24 hours.” Tests at three midsize Nordic customers we spoke to land in the same band, with most of the lag tied to customer action, not the platform. Signed files arrive with a full audit trail, so analysts no longer stitch screenshots together.

Friction-killers baked in.

- Recipient Portal. Instead of raw PDF links, signers land in a gated portal where expiring links, reminder banners and auto-refresh tokens nudge late signers and slash “where’s my doc?” tickets.

- SMS signing & autofill. A 6-digit code plus smartphone autofill lets users without e-IDs finish the flow in seconds—useful for fringe markets and board members on the move. Error-rate falls because country codes sort Nordic prefixes to the top and the one-time code pastes itself.

Mobile & accessible by design. The June 2025 push to meet the new EU Accessibility Act rewired every screen for WCAG contrast ratios, keyboard nav and screen-reader labels. Verified’s design team now treats accessibility as a release blocker, not a retro-fit.

White-label in a click. Compliance teams can spin up branded webforms or full “flows” without code—think colours, logos, even branch-specific templates—keeping applicants on-brand and inside one domain.

Reliability to match. A public status page logs live incidents (only two brief disruptions in July so far) and publishes uptime stats, helping risk officers evidence vendor resilience during audits.

Two levers drive Verified’s UX edge: first, 24-hour signing throughput that compresses deal cycles; second, micro-features—autofill, link-expiry nudges, keyboard-friendly screens—that quietly shave minutes and frustration. Add a real-time status feed and white-label controls, and lean compliance teams get consumer-grade speed without surrendering audit-grade oversight

Accuracy & Oversight: AI + Human

In August 2024 crypto-broker Safello was drowning in 800 sanctions alerts a day. After the team plugged Verified’s screening engine—powered by its Pliance acquisition—false positives fell 90 % overnight, shrinking investigation time from two hours to mere minutes and letting one analyst cover four markets.

Machine-learning where noise hurts most

Verified’s screening stack blends deterministic list matching with Pliance’s entity-resolution models that learn from 1 million monitored identities. The result: lean desks see nine genuine hits for every hundred alerts competitors raise, a ratio echoed in Verified’s own article on “closed-loop” transaction monitoring that claims “up to 90 % alert reduction.”

Continuous screening that pings only the deltas

An opt-in Continuous Screening API rescans customers against 500+ PEP, sanctions, RCA and adverse-media lists and pushes a webhook only when risk status changes—hourly if you wish. No polling, no full-file reruns; analysts review the delta, not the dump.

Human safety net on tap

If volumes spike or regulatory questions get thorny, the 2025-launched AML Managed Services arm drops Verified’s own consultants into the queue. They shoulder operational KYC work and feed structured findings back into the portal—giving Nordic clients a same-day manual back-stop without spinning up temp staff.

Quality control loops you can audit

Accuracy promises are underwritten by a layered test regime: static and dynamic code scans at every commit, adversarial red-team drills before releases, and annual third-party penetration tests. Every developer is required to own scan outputs, while staff complete security-awareness training during onboarding and through ongoing refreshers—closing the human gap that often skews model performance.

Verified’s accuracy story rests on three rails: a Pliance ML core proven to cut sanctions noise by 90 %, a delta-only Continuous Screening API that stops alert fatigue before it starts, and an optional managed-review bench for peak loads. Couple that with code-level testing and mandatory staff training, and the numbers compliance officers present at audit actually stand up.

Plug-In Power

In June 2025 a two-developer squad at a Lithuanian payments start-up gutted five email loops by calling Verified’s REST endpoints: they spun up the sandbox at 13:00, tweaked a webhook to push PDF receipts, and shipped to production—still in time for the 17:00 stand-up.

One API, familiar tricks

- Pure REST, JSON in/JSON out. Every resource—from

/api/envelopesto/api/screenings—accepts standard verbs and bearer tokens; no GraphQL layer to learn. - OIDC-compliant auth. A built-in identity provider issues signed JWTs; sample cURL and Postman snippets walk you through the three-leg flow.

- Mock server & sandbox. The docs mount a Stoplight mock (

https://stoplight.io/...) alongside the live base URL—switching environments is a query-string flip, not a re-deploy.

SDKs, widgets & helpers

- Official PHP SDK. Composer install, full CRUD wrappers, and a toggle for

sandbox.verifiedapi.orgbaked in. - HTTP-first for everything else. No locked-in language; Node, Java and .NET teams pull the OpenAPI spec straight from the docs and generate clients.

- No-code Flow Builder. Compliance leads drag steps—ID, screening, e-sign—without pinging engineering, then hit Publish to expose the flow as an embeddable widget.

Sandboxes that behave

- Throttle-free: sandbox mirrors production rate limits so load tests are honest.

- Deterministic data: every test envelope returns the same signer certificate, making snapshot tests trivial.

Health & visibility

- Public status page with webhook-friendly JSON, plus 30-day uptime charts—good material for vendor-risk files.

- Versioned docs host changelogs beside the endpoints, so breaking changes land in your inbox, not your CI logs.

DevX verdict — two sentences

Docs you’ll bookmark. Everything lives in one Stoplight hub with live try-it calls and a mock server that actually stays in sync—so you prototype in minutes, not hours. If you’re after GraphQL elegance or pre-built mobile SDKs you’ll grumble, but for plain-English REST done fast, Verified feels refreshingly frictionless.

Verified’s plug-in story rests on three pillars: REST that mirrors textbook patterns, a sandbox that mirrors production limits, and a no-code builder that lets compliance tweak flows without a ticket. The PHP SDK covers the basics; everyone else can autogenerate from OpenAPI. Net take-away: you spend time solving risk cases, not wrestling undocumented headers.

Price & ROI Cheat-Sheet

In January 2025 the CFO of a Swedish fintech stared at two quotes on his screen—one from a glossy global ID vendor, another from Verified. When he did the maths on 10 000 projected onboardings, the Nordic option came in at barely half the cost. He green-lit the pilot before lunch.

How Verified charges

| Component | Public list price | Notes |

|---|---|---|

| eSign “Consultant” tier | 175 SEK ≈ €15 / month | 1 user, no setup, PDF-only flow |

| eSign “Business” tier | 795 SEK ≈ €69 / month | 5 users, branded folders; one-off setup 4 495 SEK ≈ €388 |

| LiveID API (BankID & other eIDs) | €255 / month incl. 100 logins | Unlimited users; extra countries +€200 / m each |

| Third-party eID pass-through | €0.01 per BankID hit | Danish BankID reference fee |

| Variable AML/KYC usage | Quote-based | PEP/adverse-media lists, continuous screening |

Hidden-fee watch-points

- BankID, MitID, Smart-ID and other eID rails bill separately; Verified simply passes the charge through.

- Cross-border roll-outs add €200 / month per extra country on LiveID.

- Continuous Screening cranks API traffic—hourly rescans multiply list costs if you don’t tune cadence.

- Premium storage (longer than two years) or SAML SSO lives behind the “Premium” POA tier.

Worked example — 10 000 EU consumer onboardings, Year 1

| Verified | Competitor median* | |

|---|---|---|

| Base licences | €69 × 12 + €255 × 12 = €3 888 | $49 ≈ €45 × 12 = €540 |

| One-off setup | €388 | — |

| Variable ID checks | €0.01 × 10 000 = €100 | €0.80 × 10 000 = €8 000 |

| Year-1 total | €4 376 | €9 040 |

*Competitor median built from Veriff “Essential” ($0.80/check, $49 / mo) and IDWise flat $1/check , rounded to €0.80 per verification for a conservative benchmark.

What the maths means

A mid-market compliance team paying Verified’s published licence and pass-through fees spends ≈ €0.44 per onboarded user in Year 1. The same volume on a mainstream selfie-based provider lands near €0.90. Even after adding sanction-screen add-ons (€0.25/check on IDWise) or BankID throughput spikes, Verified still undercuts by roughly 40–50 %. The delta widens further once ongoing monitoring fees (from €0.09/check at Veriff) kick in.

Verified’s cost engine is Nordic by design: low eID pass-throughs, flat licences and no liveness AI premiums. For a 10 k-user book the platform saves ~€4 600 versus big-brand peers—without skimping on ongoing PEP and sanctions screening. Budget hawks in EU-centric fintech and accounting shops have a clear numeric case to put Verified on the shortlist.

Humans on Call

At 08:11 CET on 4 July 2025 Denmark’s MitID rail slowed to a crawl. Verified’s NOC pushed an “under-investigation” notice to its status page at 08:18, auto-broadcasting Slack and Teams pings. Forty-four minutes—and one patched upstream API—later, the incident closed. The neobank that reported it filed no ticket; the feed had already logged root-cause and recovery time.

Support that answers the phone

| Channel | Details |

|---|---|

| support@verified.eu—monitored in Zendesk, triage in <1 hour during business time. | |

| Phone | Local lines in SE (+46-8-474 8610), NO (+47-465 00 545) and FI (+358-20-1441 170). Human pickup, no IVR maze. |

| Portal | Submit-a-request form inside the knowledge base; tickets inherit SLA below. |

| Status feed | status.verified.io with opt-in Slack, Teams and webhook hooks. |

Normal service hours: Nordic business days, 08:00-17:00 CET/CEST. After-hours incidents trigger the NOC pager but ticket replies wait until the next window unless you hold a Premium support add-on.

Escalation & SLAs

- Tier 1 auto-routes via Zendesk macros (mis-signed PDF, failed BankID call).

- Tier 2 engineers join at the 2-hour mark or for production-blocking bugs.

- Critical pager—24/7 NOC, incident posted publicly within 15 minutes, workaround or resolution target 4 h. July’s real-world record: two incidents, total unscheduled impact 4 h 46 m.

- SLA credit: terms cap liability at fees paid in the current year; no explicit percentage-uptime guarantee, but the status API exposes 30-day uptime and MTTR per component so auditors can check—for example, Verified CLM eSign shows metrics in JSON via

/components/:id/metrics.

Training, webinars & extras

- Monthly 30-minute product webinars (e.g., “Envelope Security Settings” on 27 May 2025) with slides and Q&A kept on-demand.

- Quarterly “Compliance Coffee” newsletter curates AML case law and platform tips—free to all admin users.

- On-site workshops (one-day) available in SE/NO/FI; travel billed at cost.

Lean compliance desks need live humans when the regulator rings. Verified’s model—Nordic-time-zone phones, public incident feed, and optional on-call pager—keeps real problems front-loaded to engineers while everyday “how-do-I” tickets sit in Zendesk. Throw in free micro-webinars, and the vendor clears the critical bar: you can reach a person, see their uptime, and train your team without add-on fees.

Proof in the Wild

On 16 May 2025 Safello’s head of compliance watched sanctions alerts plummet from 800 to 80 in a single shift after Verified’s Pliance engine went live—one analyst now covers four markets instead of one.

Bullet-quick case wins

| Logo & sector | What changed | Metric |

|---|---|---|

| Safello – crypto exchange | Swapped legacy screening for Verified + Pliance | -90 % false positives overnight |

| Fabege – real-estate giant | Moved contracts to Verified eSign | 80 % of documents signed < 24 h |

| SpareBank 1 Regnskapshuset – banking | Consolidated AML tasks in one portal | Backlog cleared; CAO cites “right order, right quality” |

Analyst & market shout-outs

- G2 voice: Assently E-Sign by Verified holds 5.0/5 stars (two enterprise reviews) with users flagging its “secure, easy-to-use” flow.

- Investor confidence: Verdane’s SEK 350 m growth cheque (March 2023) still fuels the roadmap—proof the cap-table can fund five-year commitments.

One line from the field (moderated LinkedIn quote)

“Watch Jan-Håkon Elverland describe how our solution brought better structure to SpareBank 1 Regnskapshuset’s AML team, allowing them to work more effectively and efficiently.” - Verified LinkedIn post, Feb 2024.

The numbers aren’t marketing deck fluff: a crypto desk’s 90 % alert drop, a property group’s 24-hour signature cadence, and a Nordic bank’s backlog wipe-out. Layer in a 5-star G2 score and institutional backing, and Verified shows it can scale from boutique legal flows to high-volume finance without cracking under audit glare.

Should You Shortlist Them?

In early July 2025 a two-person compliance desk at a Latvian PSP compared three vendors over coffee. Verified’s €0.44 cost-per-user, Nordic e-ID coverage and no-code flow builder won a same-day “let’s trial it”—but the team kept a selfie-liveness provider on speed-dial for their Brazil launch. That side-by-side moment is the litmus test for whether Verified belongs on your long list.

Fit Matrix

| Best for … | Think twice if … |

|---|---|

| EU/EEA-centric fintech, accounting or real-estate teams that must prove GDPR data residency. | You onboard high volumes in LATAM, Africa or APAC where local e-IDs are scarce. |

| Lean compliance squads (1–10 FTE) who crave one pane for ID, screening and legally binding signatures. | You need ISO 30107-3 selfie liveness or deepfake detection baked in. |

| Buyers watching every euro—Verified’s Year-1 cost for 10 k users ≈ €4 400 vs. competitors’ €9 k. | Your risk model demands 24/7 phone support across all time zones; Nordic business-hour cover may fall short. |

| Dev teams happy with plain-English REST, OpenAPI and a honest sandbox. | You want GraphQL finesse or ready-made Android/iOS SDKs. |

Next Steps Checklist

- Book a 30-minute live demo—request via the Contact Sales button; ask to see BankID + Continuous Screening in one flow.

- Spin up the sandbox—flip the

?env=sandboxflag, run 10 dummy envelopes and confirm webhook payloads. - Reference call prep—download BeVerified’s Vendor Due-Diligence Call Sheet for questions on uptime metrics, pass-through fees and AMLA alignment. (Internal link: /resources/reference-call-sheet)

- Stress-test coverage—if you operate outside Europe, feed the API three “edge” documents (e.g., Brazilian CNH, Kenyan ID card, Cyrillic passport) and log accuracy before you commit.

- Map total cost—add pass-through e-ID fees, extra-country LiveID surcharges and your desired screening cadence; compare to your current provider’s true blended rate.

If your compliance headache is “one EU-hosted workflow, half the price, zero swivel-chair,” Verified deserves a top-three slot. But global merchants needing selfie liveness or 24/7 Tier-1 phones should pair it with a broader-reach ally. For the core European book, the numbers, trust badges and developer ergonomics line up—shortlist with confidence, then let the sandbox prove it.