Table of Contents Show

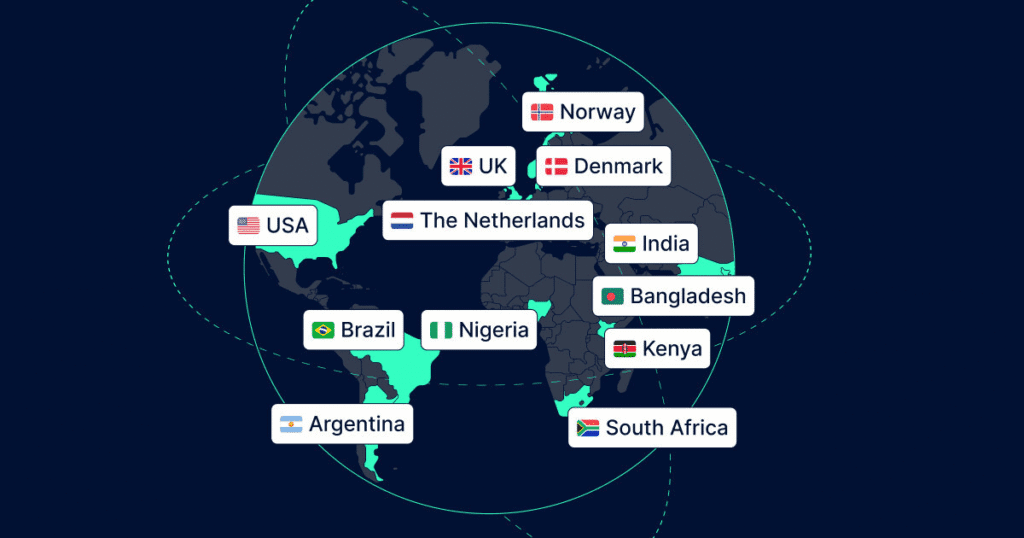

Sumsub’s identity verification platform operates in more than 220 countries and territories while supporting verification through over 14,000 document types. The broad coverage provided enables businesses to maintain global operations while meeting local regulatory standards.

The Sumsub platform provides both traditional document-based verification and Non-Documentary (Non-Doc) Identity Verification options. This solution enables users to verify identities by using data from government databases instead of requiring physical documents. FINTRAIL’s independent audit demonstrates Sumsub’s Non-Doc solution meets the regulatory requirements of 18 jurisdictions such as the UK, US, South Africa, Nigeria, and India.

Businesses looking for extensive identity verification solutions find Sumsub to be an adaptable choice because of its worldwide reach combined with strong compliance standards.

Key Features of Sumsub KYC & AML Solutions

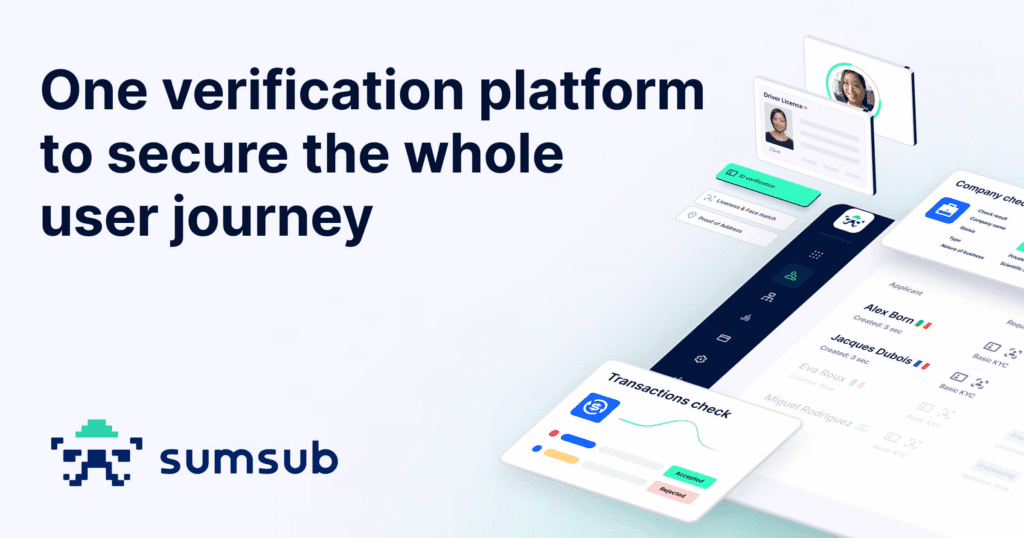

Sumsub delivers an extensive set of tools which enable businesses to simplify identity verification while maintaining compliance standards and protecting against fraudulent activities. Here is a summary of the essential features.

Identity Verification Solutions

- Document Verification: The Sumsub platform verifies more than 14,000 document types from over 220 countries and territories such as passports and residence permits. The system combines Optical Character Recognition (OCR) technology with artificial intelligence to extract data while validating it for authenticity and compliance.

- Biometric Verification: Advanced facial recognition technology enables the platform to confirm user identities through both liveness detection and face matching systems. The process achieves a completion rate of 99% while taking only one second on average for verification.

- Non-Documentary Verification: Sumsub provides Non-Doc Identity Verification for allowed jurisdictions by using government databases to verify user identities without needing physical documents.

AML Compliance Solutions

- Sanctions and PEP Screening: Sumsub conducts automatic screenings for businesses and individuals by referencing global watchlists such as OFAC, UN, HMT, EU and DFAT databases alongside Politically Exposed Persons (PEPs) records and adverse media sources.

- Ongoing Monitoring: The platform keeps an ongoing watch over client data alterations to guarantee business compliance with changing regulatory requirements.

Transaction Monitoring

- Real-Time Analysis: Sumsub’s AI-powered transaction monitoring system detects suspicious activities instantly while minimizing false positives by as much as 90%.

- Customizable Rules: Businesses have access to over 300 industry-specific pre-built rules that enable accurate anomaly detection while ensuring compliance with regulatory standards.

Fraud Detection & Prevention

- Behavioral Analysis: The platform monitors user behavior patterns to identify and block fraudulent actions including account takeovers and multi-accounting.

- Graph Neural Network Analysis: Sumsub utilizes sophisticated algorithms to detect fraud by clustering networks based on common features including shared IP addresses and device information along with document similarities.

Integration and Customization

- Flexible Integration Options: Sumsub provides multiple integration solutions such as APIs and SDKs for web and mobile platforms along with Unilink which enables identity verification through links or QR codes without requiring complete integration.

- Workflow Builder: The no-code Workflow Builder from Sumsub lets businesses create verification flows that meet their unique requirements and regulatory demands.

Sumsub provides a unified platform that helps businesses improve their fraud prevention and compliance management while boosting operational efficiency and customer satisfaction.

How Sumsub Works: Step-by-Step Process

Sumsub delivers a well-organized identity verification system that safeguards compliance and security requirements for businesses. Here’s a detailed breakdown of the process:

User Onboarding Flow

- Initiation: The verification process starts when users access Sumsub’s WebSDK or MobileSDK which a company can incorporate into its platform.

- Document Submission: Applicants must provide images of their identification documents like passports or driver’s licenses. The system can process more than 14,000 types of identity documents from over 220 different countries and territories..

- Biometric Verification: The system instructs users to capture a selfie or record a brief video for facial recognition to verify both liveness and identity document matching.

- Data Extraction and Validation: Sumsub’s AI system pulls information from documents users submit and validates this data using external sources like sanctions lists and watchlists.

- Result Handling: The verification outcome is delivered in real-time. Users receive approval, decline, or manual review after system verification results are processed.

Verification Process Explained (End-User Perspective)

- User-Friendly Interface: The verification steps display clarity and brevity while leading users through each required action.

- Real-Time Feedback: Users get direct status updates about their verification which eliminates uncertainty and shortens waiting periods

- Support for Multiple Languages: Sumsub provides a platform which accepts documents in multiple languages to serve users worldwide.

Admin Dashboard & Analytics Overview

- Centralized Management: Administrators have the capability to observe and handle every verification procedure through a unified dashboard.

- Team Collaboration: The platform enables users to add multiple team members and define their specific roles and permissions.

- Detailed Analytics: Businesses access a full range of analytics which covers verification success rates and user demographics alongside average processing times.

Sumsub delivers a smooth and protected verification process for its users and administrators through its structured methodology.

Pricing and Alternatives

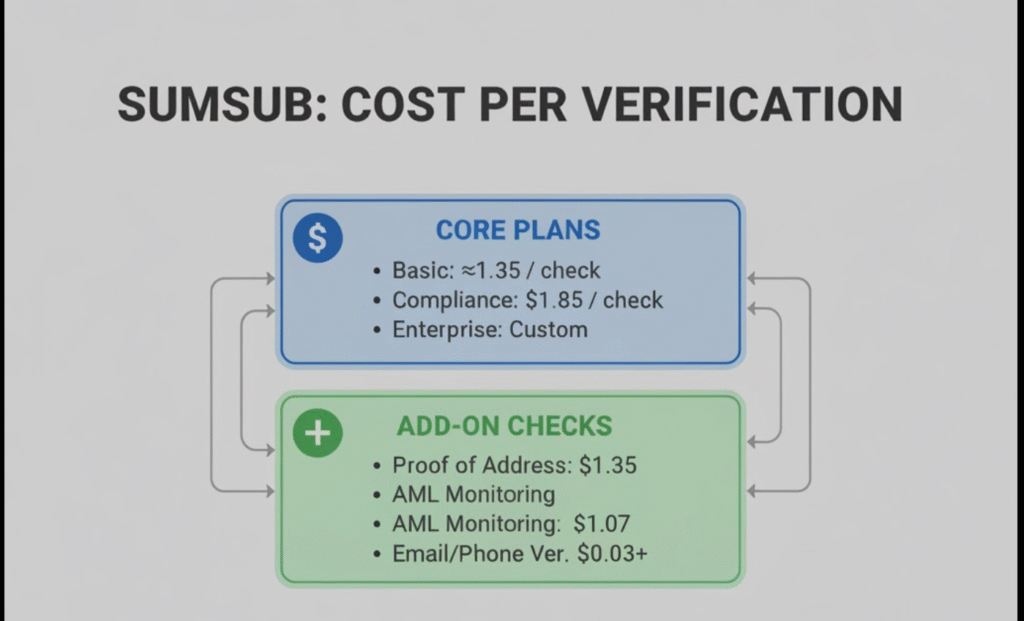

Sumsub provides businesses with diverse pricing scales based on their size and industry requirements through its flexible and scalable model. Sumsub maintains a pricing structure based on usage or verification volume but does not disclose complete pricing details on their website.

Pricing Per Check

Sumsub Alternatives

Sumsub stands on par with Onfido, Jumio, and Veriff regarding competitive pricing and value offerings. Sumsub is not the least expensive option available yet businesses select it for its comprehensive compliance features and quick verification process along with integration flexibility.

| Feature | Sumsub | Onfido | Jumio | Veriff |

|---|---|---|---|---|

| Pricing Transparency | Custom Quotes | Tiered Plans | Custom Quotes | Tiered Plans |

| Free Trial | Demo Available | No | No | Yes (Limited) |

| Biometric Checks | Included in KYC | Add-on | Included | Included |

| AML Screening | Available | Limited | Available | Available |

| Geographic Reach | 220+ countries | 190+ countries | 200+ countries | 190+ countries |

(Pricing and features comparison is based on publicly available data and may vary.)

Cost Optimization Tips for Businesses

- Start with Core KYC: Startup and early-stage businesses should start with the basic KYC verification package before moving on to KYB and AML once they need additional compliance services.

- Leverage Tiered Discounts: Companies that experience customer growth should negotiate volume discounts at the start to lower their per-verification expenses.

- Use Workflow Customization: Customizing verification flows according to different user risk profiles helps businesses prevent unnecessary expenses on excessive checks.

Customer Reviews & Testimonials

Sumsub has established itself as a trusted solution for digital identity verification within highly regulated sectors including fintech, crypto, iGaming and transportation. The feedback from public users highlights Sumsub’s strong points alongside improvement areas while providing a realistic assessment of the platform’s performance.

Customer Satisfaction Overview

Sumsub consistently earns high ratings across major review platforms:

- G2: 4.7/5 (as of 2024)

- Capterra: 4.6/5

- Trustpilot: 4.5/5 (based on service quality and support responsiveness)

Most users giving positive feedback praise the platform for its quick performance along with user-friendly operations and dependable compliance features. Clients frequently observe that the verification process completes in under sixty seconds per user while competitors generally take longer.

Common Praises

- Fast verification process: Users often praise the system because identity checks have low friction while maintaining high success rates.

- Excellent customer support: Businesses value technical support that responds promptly along with guidance throughout the integration process.

- Global coverage: International clients require support options that accommodate diverse documents and multiple languages.

- High configurability: Businesses appreciate the ability to design specialized workflows which meet their compliance requirements and risk management approaches.

“Sumsub helped us onboard users across 100+ countries while maintaining compliance. Their support team was crucial to getting us live quickly.”

— Compliance Lead, Crypto Exchange (via G2)

“Integration was seamless and the dashboard is intuitive. We were able to reduce fraud and boost approval rates within weeks.”

— Product Manager, Neobank (via Trustpilot)

Constructive Criticisms

While overall satisfaction is high, some clients have noted areas for improvement:

- Pricing Transparency: Some small businesses struggle to understand pricing models because public pricing information is not available.

- False positives in AML: Several users reported that the sanctions screening system sometimes misidentifies legitimate users who must go through manual verification.

- Learning curve: New users might need onboarding help to exploit its powerful features effectively.

“The product is great, but the documentation could be more beginner-friendly for startups without full compliance teams.”

— Startup CEO (via Capterra)

User Ratings on Third-party Platforms

| Platform | Average Rating | Most Cited Strengths |

|---|---|---|

| G2 | 4.7/5 | Speed, customization, support |

| Capterra | 4.6/5 | API quality, fraud prevention |

| Trustpilot | 4.5/5 | User-friendliness, global reach |

Customer feedback for Sumsub demonstrates its success as a compliance partner for businesses functioning within regulated or high-risk industries. The combination of quick onboarding processes combined with strong customer support and geographic flexibility positions Sumsub as a leading choice for KYC/AML solutions while users simultaneously demand improved pricing transparency and documentation clarity.

Sumsub vs Alternatives

| Feature | Sumsub | Onfido | Veriff | Jumio |

|---|---|---|---|---|

| Global Document Coverage | ✅ 220+ countries | ✅ 195+ countries | ✅ 190+ countries | ✅ 200+ countries |

| Workflow Customization | ✅ Full flexibility | ⚠️ Limited | ⚠️ Moderate | ✅ Strong |

| AML & KYT Included | ✅ Yes | ⚠️ Add-ons | ✅ Yes | ✅ Yes |

| Pricing Transparency | ❌ Quote-only | ⚠️ Tiered plans | ⚠️ Tiered plans | ❌ Quote-only |

| Integration Flexibility | ✅ High | ✅ Medium | ✅ Medium | ✅ High |

Sumsub stands out for its global reach, customizable architecture, and full-stack compliance tools. It is best suited for companies in regulated industries or those with international operations. However, smaller startups or teams with limited technical capacity may want to factor in the learning curve and upfront integration needs before adoption.

Compliance Provider Scorecard

Compliance Provider ScorecardGood for

- Its international document coverage and AI-powered verification speed are particularly well-suited for businesses with a global customer base.

- Businesses can create customized onboarding flows that address specific customer risk levels and regulatory requirements through the platform’s modular architecture while avoiding unused features.

- The design approach focused on developers provides strong APIs and SDKs along with sandbox environments which facilitate easy integration across mobile and web platforms.

- Sumsub delivers dedicated tools including liveness detection, KYT (Know Your Transaction) modules and continuous AML monitoring to crypto, fintech, iGaming and mobility service sectors enabling them to satisfy tough global standards.

Think twice if

- The absence of public pricing may create friction for startups or budget-conscious businesses evaluating providers.

- Integration and onboarding may require involvement from development and compliance teams, especially for advanced configurations.

- Businesses operating in niche or lower-risk industries might find some features overly robust for their immediate needs.