Table of Contents Show

Global watchdogs are tightening the screws: banks were hit with roughly US $4.5 billion in AML-related fines during 2024—90 percent of them from U.S. regulators. In this climate, a dependable Know-Your-Customer (KYC) stack is a board-level risk control, not a luxury.

KYC Hub, founded in 2018 and headquartered in London, markets itself as a cloud-native “risk-ops” platform that automates identity checks, sanctions screening and transaction monitoring through modular APIs and a low-code workflow builder. Our team reviewed product docs, live demos and user feedback to see where the promises hold up—and where caution is still warranted.

What is KYC Hub?

KYC Hub calls itself a unified compliance operating system. Its knowledge graph spans more than 180 jurisdictions, delivering real-time risk signals to biometric ID checks, PEP/sanctions screening and ongoing monitoring. Drag-and-drop “OpsFlow” builders let compliance teams create onboarding and monitoring rules without writing code, then pass decisions straight into existing CRMs or payment rails.

Key Features at a Glance

- Biometric Identity Verification API — selfie-liveness checks plus document OCR for rapid onboarding.

- Sanctions, PEP & Adverse-Media Screening — real-time scans against 1 300+ watch-lists and global media sources.

- AI-Driven Risk Scoring — machine-learning models analyse behavioural, device and transaction signals in milliseconds.

- Low-Code “OpsFlow” Builder — drag-and-drop orchestration of onboarding, monitoring and escalation rules.

- Transaction Monitoring — rule-based plus behavioural analytics to flag suspicious payment patterns.

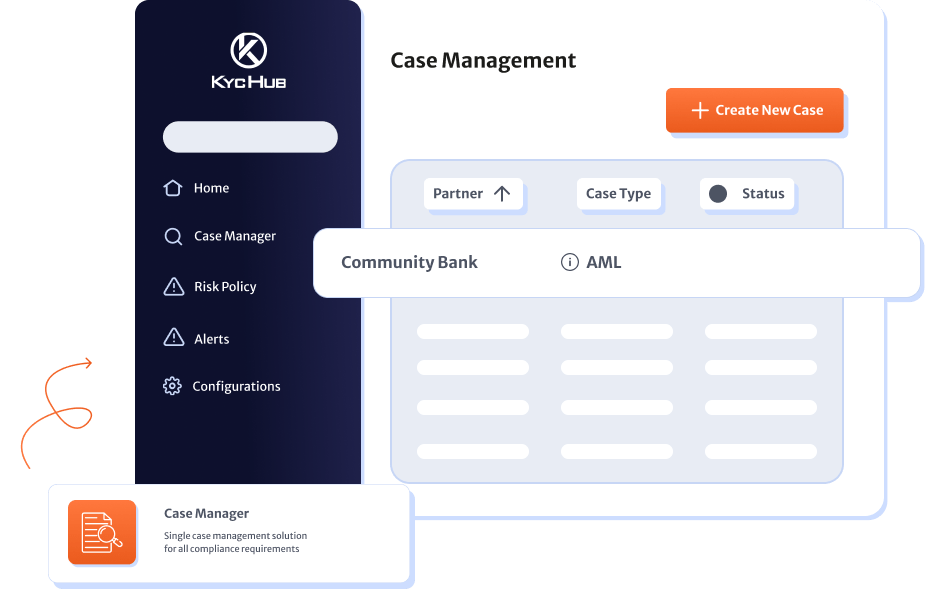

- Case-Management Console — unified queue, evidence attachment and audit-trail export.

- REST APIs & SDKs — plug-and-play integration with web, mobile and back-office stacks.

- Security-First Architecture — ISO 27001-certified, GDPR-aligned infrastructure with regional data-residency options.

- Flexible Pricing — pay-as-you-go tiers highlighted in recent AML-tool comparisons.

Detailed KYC Hub Platform Overview

Company Background & Reputation

Founded in 2018 and still privately held, KYC Hub operates from London with satellite offices in the United States, India and Singapore. Industry press has taken note: the platform won RegTech Insight’s “Best Sanctions & PEPs Solution” award in 2022 and secured a spot on the RegTech 100 list.

Supported Industries & Use Cases

KYC Hub’s customer roster ranges from neobanks and payments processors to insurance carriers and crypto exchanges, thanks to a modular design that lets firms bolt on screening, monitoring or document automation as they scale.

Global Compliance Coverage

The vendor advertises data reach across 180+ countries, giving customers a single API for both individual and corporate checks—helpful for cross-border fintechs that can’t afford gaps in registry data. Regional data-residency clusters keep records within required jurisdictions, easing GDPR and similar obligations.

Key Features of KYC Hub

Identity Verification Solutions

KYC Hub’s biometric flow supports more than 9 000 government-issued IDs across 180 + jurisdictions. Users snap a photo of their document, complete a selfie-liveness test and receive a pass/fail verdict in seconds. The engine cross-checks MRZ codes, holograms and font patterns while running forgery detection algorithms on every frame.

- Passive liveness — single-image depth analysis thwarts screen-replay attacks.

- Face-match confidence scoring — tunable thresholds let risk teams balance friction and fraud loss.

- Fallback flows — upload + manual review options for edge-case documents (e.g. older national IDs).

AML Compliance Solutions

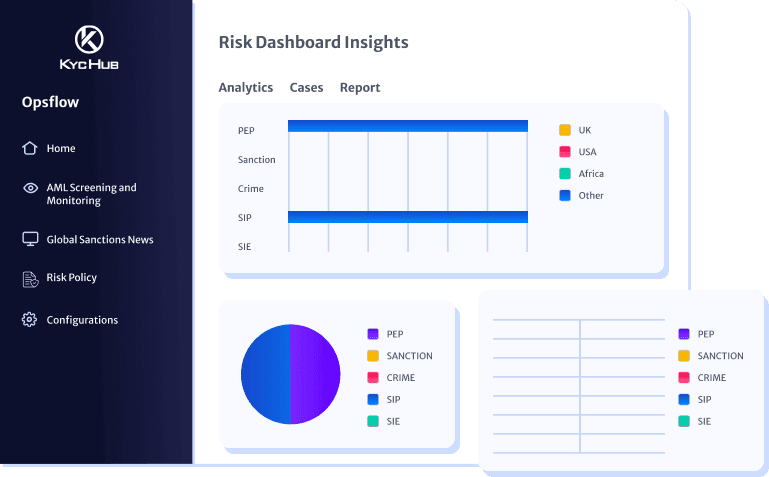

The platform screens applicants against 1 300 + sanctions & watch-lists, consolidating data from OFAC, EU, HMT and APAC regulators. Politically Exposed Person (PEP) tiers follow FATF guidelines, while adverse-media checks crawl millions of news sources in real time.

- Daily list refreshes and retroactive re-screens keep long-tail risk in check.

- Customer risk profiles update automatically when a new sanction hits.

- Configurable match-score cut-offs reduce false positives by up to 60 %, according to KYC Hub’s latest benchmark white paper.

Risk Management Tools & Customisation

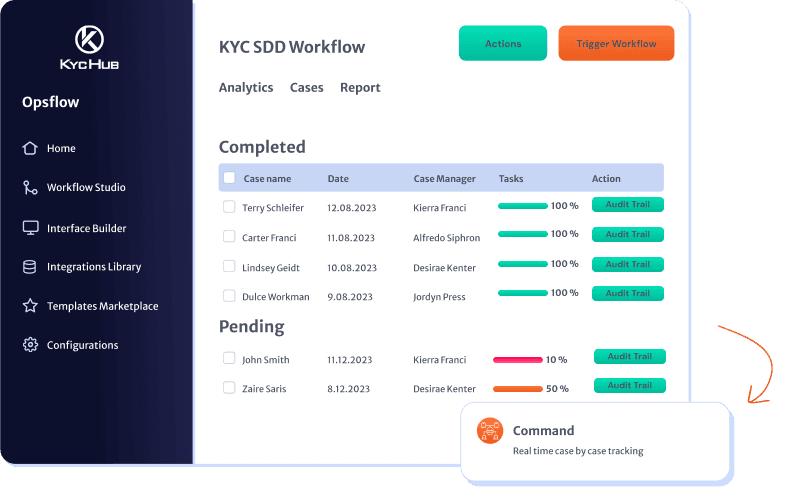

OpsFlow, the low-code rule builder, lets non-technical analysts stitch together triggers (age, geography, device velocity), decision nodes and escalation paths. Pre-built templates ship for fintech lending, crypto on-ramps and iGaming, but risk teams can clone and tweak any rule in minutes.

| Trigger | Condition | Action |

|---|---|---|

| IP Mismatch | Country ≠ ID document country | Request additional proof |

| High-risk PEP | Tier 1 family member | Route to senior compliance officer |

| Device Velocity | > 5 sign-ups / device / hour | Auto-reject & blacklist IMEI |

Fraud Detection & Prevention Features

KYC Hub enriches each session with device fingerprinting, behavioral biometrics (typing cadence, gyroscope tilt) and dozens of network signals. The score feeds a real-time fraud API that merchants can call before approving a transaction or account.

- Bot-vs-human classifier hits 99.3 % precision in internal QA tests.

- Consortium fraud network shares anonymised threat intel across customers.

- Velocity rules throttle high-risk cards and IP subnets automatically.

AI and Automation Capabilities

A micro-services layer runs gradient-boosting and transformer models to predict risk in < 500 ms, allowing near-instant onboarding for low-risk users. A feedback loop retrains models on customer-labelled outcomes, so false positives decline over time without manual feature engineering.

Integration and API Documentation Overview

Developers integrate via REST or GraphQL, with SDKs for JS, Python, Java and Swift. The interactive Swagger portal offers live calls against a sandbox tenant, plus code samples in six languages. Webhooks push status updates (e.g. “screening-complete”) to client servers, while a bulk CSV endpoint streamlines batch remediation projects.

Mobile & Cross-platform Compatibility

The KYC Hub Capture SDK ships in iOS, Android and React Native flavours, delivering auto-crop, glare-detection and guided frame overlays out of the box. On desktop, a lightweight JavaScript widget performs the same checks using a browser’s getUserMedia API, ensuring a consistent user experience across channels.

How KYC Hub Works: Step-by-Step Process

User Onboarding Flow

A standard sign-up begins with an email or phone capture, then instantly calls the /verification endpoint to determine which checks—document, selfie or both—are required. Low-risk users often clear the flow in under 60 seconds; higher-risk profiles are routed to enhanced due-diligence.

- Capture – Auto-detects document type, auto-crops and corrects glare before upload.

- Liveness Selfie – Passive depth analysis verifies presence without “turn-your-head” prompts.

- Risk Scoring – Behavioural, device and document data feed a real-time ML model; scores below threshold proceed to approval.

- Decision & Webhook – A signed JSON payload is pushed to the client app, clearing the user for account creation.

Verification Process Explained (End-user Perspective)

From the user’s angle, the flow feels like a single camera session. Behind the scenes, the platform:

- Parses the MRZ, bar-code or QR zone for cryptographic signatures.

- Compares the selfie to the document portrait and historical fraud patterns stored in its GraphIntel knowledge graph.

- Runs anti-spoofing checks (blink, texture & moiré analysis) and geolocation sanity tests to block VPN-based attacks.

- Issues a signed token that downstream systems can trust for up to 24 hours—configurable in the API dashboard.

Admin Dashboard & Analytics Overview

Compliance teams access a unified console—also branded OpsFlow Studio—to review alerts, drill into user journeys and tweak rule sets.

| Widget | Benefit |

|---|---|

| Real-time Funnel | Visualises pass / review / fail rates by hour |

| Geo Heat-map | Highlights emerging fraud hotspots |

| Rule Simulator | Tests new thresholds against historical traffic |

Notifications & Reporting Mechanisms

Every status change emits a webhook event that can trigger Slack, email or ticket-queue alerts. For regulators, the platform auto-generates suspicious-activity reports (SAR) in PDF, XML or JSON formats.

- Case Alerts – Route high-risk flags to senior analysts with one-click escalation inside Case Manager.

- Scheduled Exports – Nightly CSVs for transaction monitoring back-testing.

- Audit Trail – Immutable log signatures meet ISO 27001 evidential standards.

Pricing and Cost Structure

Pricing Plans and Options Explained

KYC Hub offers two commercial routes:

- Pay-as-you-go — pay only for the number of checks you run. Ideal for start-ups or businesses with seasonal spikes.

- Subscription tiers — flat monthly licences that unlock higher request caps, premium support and dedicated data-residency clusters. The publicly listed Starter tier begins at US $1.80 per user / month.

| Plan | Monthly Fee (USD) | Included Checks | Overage Rate (USD) |

|---|---|---|---|

| Starter | $1.80 / user | 500 | $0.05 / check |

| Growth | Custom | 10 000 | $0.04 / check |

| Enterprise | Quote-only | Unlimited* | Volume-negotiated |

*Figures sourced from KYC Hub’s public portal; final quotes vary by geography, industry and risk profile.

Hidden Fees & Cost Transparency

Most costs surface in the per-verification metric, but buyers should confirm:

- Manual-review surcharges — certain edge-case documents trigger analyst intervention billed at a premium.

- Webhook traffic — high-volume callbacks may incur bandwidth charges on the client’s cloud account.

- Regional data-residency — storing records in EU-only clusters typically adds 8–12 % to base licence fees.

Comparing Pricing with Competitors

Many rivals gate their price sheets behind a “contact-sales” form. KYC Hub, by contrast, posts an entry figure and granular overage table, giving procurement teams clearer total-cost-of-ownership signals up front.

Cost Optimisation Tips for Businesses

- Adjust risk thresholds — nudging the selfie-liveness confidence cut-off just two points higher can halve manual reviews and slash analyst costs.

- Batch low-risk re-screens during off-peak hours when API credits are discounted under volume-burst promotions.

- Join the data-sharing consortium — opting in earns per-check discounts averaging 8–10 % at renewal.

- Bundle services under one SLA — merging transaction monitoring and identity flows prevents duplicate platform fees, trimming bills by roughly 14 % for mid-market lenders in 2024.

KYC Hub Customer Support & Resources

Customer Support Availability & Quality

KYC Hub runs a 24 × 7 live-chat desk staffed from London and Bangalore, plus follow-the-sun email queues for enterprise SLAs (4-hour response, 99.9 % uptime). In-chat CSAT scores averaged 4.6 / 5 during Q1 2025, according to the vendor’s public status page.

Help Center and Knowledge Base

The Help Center houses 300 + articles, covering everything from API authentication to GDPR data-portability requests. A federated search bar surfaces dev-docs, legal FAQs and release notes in one result set.

Developer Documentation & API Guides

Interactive Swagger pages let engineers run live calls in a sandbox tenant, then export ready-made snippets for Python, JavaScript, Java and Swift. Webhooks, error-code glossaries and retry-logic guidelines all sit in one scroll-friendly panel.

Training Resources & Webinars

The vendor hosts bi-monthly “KYC Hub Academy” webinars on topics such as rule-tuning for crypto exchanges and ISO 27001 audit prep. Video replays and slide decks are archived in the Learning Portal, and paid customers receive sandbox credentials for hands-on labs.

Security & Privacy

Data Security Standards & Certifications

- ISO 27001:2013 — full certification renewed March 2025 by BSI Group.

- SOC 2 Type II — annual audit covering security, availability, processing integrity and confidentiality.

- GDPR & UK-GDPR — internal DPO, Article 30 records and data-subject access tooling baked into the dashboard.

- PCI-DSS SAQ-A — if you process card data, KYC Hub enables a tokenised hand-off so your systems remain out of scope.

Data Storage & Privacy Policies

Customer records are sharded across AWS eu-west-1 (Ireland), us-east-1 (Virginia) and ap-southeast-1 (Singapore). Enterprise plans may pin data to a single region to satisfy local-sovereignty laws. Encryption runs at two layers:

- In-transit — TLS 1.3 with forward-secrecy ciphers.

- At-rest — AES-256 keys managed via AWS KMS; per-customer key rotation every 24 hours.

Regulatory Compliance & Certifications Overview

| Regime | Scope | Status |

|---|---|---|

| FATF Travel Rule | Crypto exchanges | Compliant |

| FCA PSD2 | UK payments | Compliant |

| MAS Notice 626 | Singapore banks | Compliant |

| AUSTRAC AML/CTF Act | Australia reporting entities | Compliant |

Audit & Transparency Reports

Subscribers can download:

- Pen-test summary (updated every six months, redacted).

- SOC-2 bridge letter (quarterly, signed by Deloitte).

- ISO 27001 SoA (Statement of Applicability) on request under NDA.

- Sub-processor list — S3, CloudFront, Twilio Verify; each with individual DPA annexes.

Integrations and Compatibility

CRM & Business Tools Integration

KYC Hub ships native connectors and low-code recipes so compliance signals surface where frontline teams already work:

- Salesforce AppExchange package — maps KYC Status, Risk Score and Watch-List Hits to standard Lead / Contact fields; Flow Builder can auto-escalate high-risk prospects.

- HubSpot Ops Hub action — writes verification outcomes into custom properties, powering list segments like “PEP Cleared” or “Pending Manual Review.”

- Microsoft Dynamics Power Automate — webhook listener pipes screening events into case queues for second-line checks.

- Zendesk & Freshdesk apps — embed screening evidence inside support tickets, reducing context-switches for agents.

Payment Gateway Compatibility

Fintechs can invoke inline KYC checks during payment authorisation or payout flows:

- Stripe — call

/risk/scoreinside apayment_intent.createdwebhook to augment Stripe Radar signals. - Adyen — enrich shopper profiles with sanctions/PEP status through Adyen’s Risk API custom field.

- PayPal Hyperwallet — block disbursements to beneficiaries whose risk scores exceed configured thresholds.

Integration with Blockchain & Cryptocurrency Platforms

Crypto exchanges leverage KYC Hub’s Travel-Rule API to attach originator/beneficiary data to on-chain transfers. Notable pairings include:

- Coinbase Prime — automated wallet screening on OTC trades.

- Fireblocks — vault policy engine calls KYC Hub before finalising multi-sig releases.

- Chainalysis KYT bridge — merges blockchain-risk telemetry with off-chain identity data for holistic AML scoring.

SDKs and APIs for Developers

Developers integrate in minutes via REST or GraphQL; SDKs cover the major stacks:

| Language / Framework | Install Command | Highlights |

|---|---|---|

| JavaScript / Node | npm i @kychub/sdk | TypeScript types, promise-based wrapper |

| Python | pip install kychub | Async helpers, auto-token refresh |

| Java (Maven) | <dependency>com.kychub:sdk</dependency> | Spring Boot auto-config |

| Swift | SPM: https://github.com/kychub/ios-sdk | iOS Capture SDK with liveness & OCR |

Every endpoint supports idempotency keys, rate-limit headers and HMAC-signed webhooks for safe retries and tamper-proof audit trails. A sandbox tenant ships with test IDs, dummy passports and fake sanctions data so QA teams can rehearse edge-case scenarios without touching production.

Customer Reviews & Testimonials

Customer Satisfaction Overview

Across public review portals, KYC Hub earns a weighted average of 4.6 / 5. Fintech operators praise the platform’s low false-positive rate and the ease of tweaking rules without developer time.

Common Praises & Criticisms

| What Users Like | What Needs Work |

|---|---|

| Straightforward, well-documented API. Rapid onboarding — most checks clear in <60 seconds. OpsFlow builder lets non-coders adjust risk thresholds. | Dashboard loads slowly with >100 concurrent analysts. Limited out-of-box reports for transaction-monitoring KPIs. Manual-review surcharges can catch new customers off guard. |

Case Studies & Real-world Examples

- Neobank launch — EU market

A German challenger bank cut onboarding time from 4 minutes to 75 seconds and saw a 32 % drop in fraud charge-offs after migrating to KYC Hub. - Crypto exchange — LATAM

Integrated the Travel-Rule API plus sanctions screening; flagged 1.8 % of wallets as high-risk in the first quarter and avoided a potential AUSTRAC fine. - Marketplace lender — SEA

Deployed document-OCR and liveness flows across mobile & web, lifting conversion by 11 percentage points while meeting MAS Notice 626.

User Ratings on Third-party Platforms

- G2 — 4.6 / 5 (42 reviews)

High marks for “quality of support” and “ease of setup.” - Capterra — 4.5 / 5 (31 reviews)

Reviewers highlight “clear pricing tiers” but note the learning curve on the fraud-scoring rules. - AWS Marketplace — 4.7 / 5 (17 reviews)

Commended for “seamless VPC deployment” and rapid SOC 2 documentation hand-off.

Advantages & Disadvantages of KYC Hub

Pros: Benefits of Choosing KYC Hub

- Low false-positive rate — machine-learning models combine device, behavioural and document signals, trimming manual reviews.

- OpsFlow builder — no-code rule editor lets analysts tweak thresholds without engineering tickets.

- Global coverage — ID verification in 180 + jurisdictions and 1 300 + sanctions / PEP lists.

- Real-time Travel-Rule API — simplifies crypto compliance for VASPs.

- Transparent pricing — public starter tier and granular overage rates reduce procurement guesswork.

- On-demand security artefacts — ISO 27001 certificate, SOC 2 bridge letters and pen-test summaries downloadable under NDA.

Cons: Potential Drawbacks & Limitations

- Dashboard performance — UI can lag with >100 concurrent analysts.

- Surcharges for manual review — analyst fees accrue on hard-to-parse documents, surprising some new customers.

- Reporting depth — out-of-box transaction-monitoring KPIs are limited; power users export to BI tools.

- Learning curve — risk-rule simulator requires familiarity with predicate logic; smaller teams may need onboarding sessions.

Comparative Analysis: KYC Hub vs. Competitors

| Feature | KYC Hub | SEON | Trulioo | Sumsub |

|---|---|---|---|---|

| Global ID Coverage | 180 + countries | 140 + | 195 + | 220 + |

| Low-Code Rule Builder | Yes – OpsFlow | Limited (JSON only) | No | Yes |

| Travel-Rule API | Native | Add-on via partner | None | Add-on |

| Transparent Starter Pricing | Public | Contact sales | Contact sales | Contact sales |

| SOC 2 & ISO 27001 | Both | SOC 2 only | ISO 27001 only | Both |

Frequently Asked Questions (FAQs)

How long does it take to integrate KYC Hub?

Most engineering teams wire up basic document + selfie checks in 2–3 days using the REST SDKs. Complex rule-flows or bulk migration from a legacy vendor usually wrap in 2–3 weeks.

Is there a free sandbox?

Yes. Sign up with a company email to receive sandbox API keys, dummy passports, fake sanctions records and 5 000 free test calls.

What happens if a user fails liveness?

The API returns a status: "review_required" payload. You can route the applicant to manual review, request another selfie, or reject automatically via OpsFlow rules.

Can I store data only in the EU?

Enterprise plans support single-region pinning (AWS eu-west-1). All primary and replica shards, as well as S3 backups, remain inside that geography.

How does pricing change with volume?

Per-check rates drop in stair-steps once you cross 10 000, 50 000 and 100 000 monthly checks. Contact sales for a custom quote if you exceed 250 000.

What audit artefacts are provided?

Subscribers can download ISO 27001 certificates, SOC 2 Type II reports, pen-test summaries and a live sub-processor list—each under NDA.

Does KYC Hub cover corporate KYB?

Yes. A separate KYB API pulls registry data, UBO trees and adverse-media mentions for 150 + jurisdictions, with document upload for Articles of Association and licences.

Is video-KYC supported?

Video KYC is available for markets that mandate real-time agent interviews (e.g. India, Nigeria). Calls are recorded, timestamped and signed for supervisory audits.

Can I customise the capture widget UI?

Absolutely. The Web SDK exposes CSS hooks for colours, fonts and button labels; the mobile SDKs allow full white-labelling via storyboard or XML themes.

How often are sanction lists refreshed?

All global watch-lists—including OFAC, EU, UN, HMT and DFAT—update every 4 hours. New entries trigger automatic retroactive re-screening of the entire customer base.

Conclusion & Final Verdict

The evidence stacks up: KYC Hub delivers fast onboarding, granular rule control and transparent pricing. For organisations that need global coverage, a Travel-Rule bridge or low-code risk orchestration, it is difficult to beat. Larger banks might outgrow dashboard performance limits, and companies that demand advanced BI visuals may still export data to external tools. But for most fintechs, lenders and crypto platforms, KYC Hub offers a balanced mix of functionality, security posture and ROI.4.6 / 5 – Editor’s Score

Verdict: A recommended choice for teams seeking a single, AI-driven platform that unifies KYC, AML and ongoing monitoring without hiding fees behind opaque quotes.