Table of Contents Show

KYCAID stands as a complete solution for enterprises needing powerful KYC and AML services as regulatory compliance and digital security become top business priorities. KYCAID launched in 2018 to provide a technological platform that streamlines identity verification processes while reducing fraud and maintaining compliance with global standards.

Compliance Provider Scorecard

Compliance Provider ScorecardWhat is KYCAID?

KYCAID operates as an integrated compliance platform which delivers multiple services through identity verification, document authentication, biometric analysis and continuous monitoring. The platform provides tailored solutions for multiple industry needs such as fintech, healthcare, e-commerce along with others to ensure compliance with specific regulations. KYCAID delivers smooth customer onboarding alongside global risk management capabilities through its operations which reach 200 countries and support more than 10,000 document types.

Key Features at a Glance

- Comprehensive Verification Services: KYCAID offers multi-layered verification, including document checks, biometric facial recognition, and liveness detection, ensuring high accuracy in identity validation.

- Global Compliance Coverage: The platform supports compliance requirements across various jurisdictions, facilitating international business operations without the complexity of navigating diverse regulatory landscapes.

- Real-Time Monitoring: Continuous screening against global watchlists, including PEPs and sanctions lists, helps in proactive risk management and compliance maintenance.

- Flexible Integration: KYCAID provides versatile integration options through APIs and SDKs, allowing businesses to incorporate its services seamlessly into existing systems.

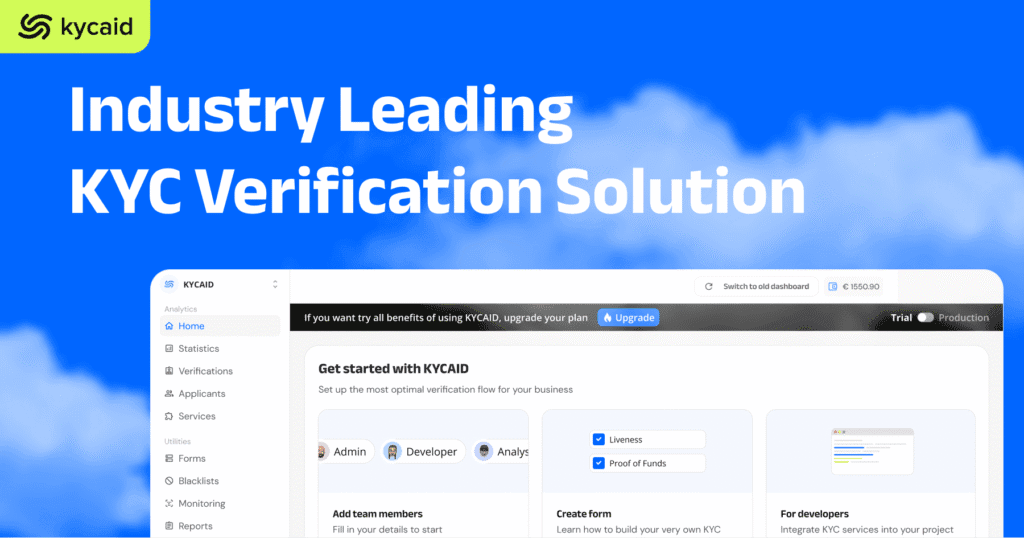

- User-Friendly Dashboard: The platform’s intuitive interface streamlines verification management while offering real-time analytics and reporting tools to monitor compliance status.

Through the use of KYCAID’s complete KYC and AML solution set businesses attain improved compliance status while protecting against risks and nurturing safe customer interactions within today’s digital commercial environment.

Detailed KYCAID Platform Overview

Company Background & Reputation

KYCAID started in 2018 and has become a full-service compliance solution provider focusing on Know Your Customer (KYC) and Anti-Money Laundering (AML) systems. The company serves businesses worldwide throughout 248 territories and manages more than 10,000 different document types. Through a combination of automated AI-driven checks and expert compliance specialists KYCAID achieves precise and efficient identity verification procedures.

The platform functions to minimize risks for businesses across various industries while improving customer interactions and making compliance processes more straightforward. Through its dedication to innovation and customer service KYCAID has become a dependable partner for organizations looking for strong compliance solutions.

Supported Industries and Use Cases

KYCAID offers versatile solutions across multiple industries to help them comply with their unique regulatory needs. Key industries include:

FinTech & Neobanks: Achieving secure financial transactions demands thorough identity verification combined with AML screening for compliance.

Cryptocurrency Exchanges & Blockchain Projects: Our platform assists cryptocurrency exchanges and blockchain projects to meet international regulations in the fast-changing digital asset market.

Online Marketplaces & E-commerce: Protecting online marketplaces from fraud requires identity verification for both buyers and sellers.

GetApp

Gaming & Gambling Industry: The Gaming & Gambling Industry uses age verification and fraud prevention strategies to meet industry regulatory requirements.

Travel & Hospitality Services: Secure identity verification processes boost customer trust and safety in travel and hospitality services.

KYCAID’s customizable verification workflows provide benefits to healthcare, legal services, real estate, insurance, and adult content platforms as additional served sectors.

kycaid.com

Global Compliance Coverage

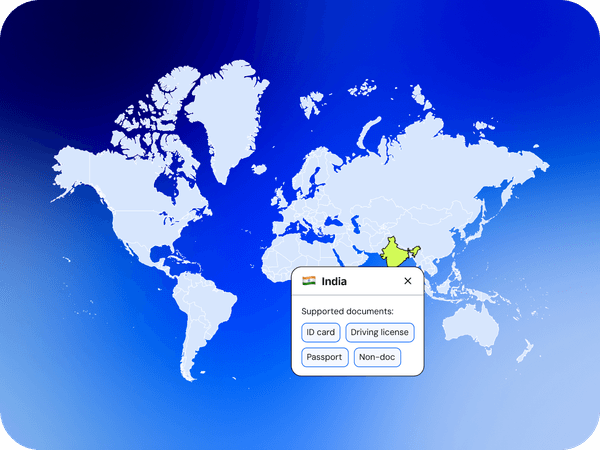

KYCAID provides broad international coverage by enabling compliance with regulations throughout multiple jurisdictions. KYCAID’s platform maintains operational presence in more than 200 countries and territories such as Brazil and India along with Kazakhstan, Turkey, Mexico, Nigeria, Ukraine, and Peru.

KYCAID’s comprehensive support allows businesses to expand their operations globally while being assured that their solutions comply with multiple regulatory standards. The platform’s capacity to process multiple document types together with its multilingual features improve its effectiveness for worldwide business activities.

KYCAID provides a powerful platform with a full range of KYC and AML solutions that are customized for different industry requirements across multiple jurisdictions. The combination of cutting-edge technology with dedicated compliance support makes KYCAID a valuable tool for businesses seeking to uphold regulatory standards while earning customer trust.

Key Features of KYCAID KYC & AML Solutions

KYCAID delivers an all-encompassing set of KYC and AML resources that fulfill the different compliance requirements businesses need from multiple industry sectors. By integrating sophisticated technologies with adaptable workflows the platform delivers efficient and safe identity verification methods.

Identity Verification Solutions

KYCAID enables real-time authentication for multiple document types such as passports, national IDs, driver licenses, and residence permits. The system rapidly determines both document types and countries to allow immediate online identification verification.

KYCAID employs AI-based facial recognition alongside liveness detection methods to verify that the document presenter is its rightful owner. The platform implements both passive and active methods for checking liveness to verify the identity of users.

The platform supports address verification for over 240 countries and territories to verify that customers’ residential addresses correspond with provided documentation.

AML Compliance Solutions

KYCAID provides transaction monitoring tools that help businesses identify and report suspicious financial activities while adhering to AML laws.

The platform performs rapid initial screening and maintains daily checks against international watchlists including Politically Exposed Persons (PEPs) and sanction lists to strengthen security and ensure compliance with AML/CTF standards.

KYCAID’s AML screening process checks adverse media sources to determine potential customer risks.

Risk Management Tools & Customization

Fraud Detection & Prevention Features: AI-driven algorithms help the platform identify and stop fraudulent behaviors including multi-accounting and multiple identity usage. Businesses can configure automated protocols to stop repeated attempts while safeguarding compliance standards.

AI and Automation Capabilities: KYCAID uses sophisticated artificial intelligence and machine learning mechanisms to deliver dependable identity authentication. The system allows companies to tailor their verification processes according to the unique requirements of their specific industries.

Integration and API Documentation Overview

Mobile & Cross-platform Compatibility: KYCAID provides smooth integration between multiple channels which spans both web and mobile platforms. Users can create exceptional experiences through multiple integration methods available on the platform including pure API integration and Forms integration as well as Mobile SDKs.

Businesses can strengthen their compliance posture and reduce risks while building secure customer relationships by using KYCAID’s strong KYC and AML solutions in today’s digital marketplace.

How KYCAID Works: Step-by-Step Process

KYCAID delivers a fully digital KYC/AML verification system that provides both security and efficiency while meeting business compliance requirements from multiple sectors. The platform integrates AI automation with human supervision to maintain both accuracy and efficiency.

User Onboarding Flow

KYCAID’s user onboarding process aims to deliver an intuitive experience while maintaining efficiency.

- Data Collection: Users submit required personal data which consists of their full name, date of birth, residential address and contact information.

- Document Submission: Users must upload identification documents for verification purposes which include passports alongside national IDs and driver’s licenses.

- Biometric Verification: To verify user identity the platform uses facial recognition alongside liveness detection technology.

- Address Verification: The platform verifies proof of address by checking utility bills and bank statements.

- Real-Time Screening: KYCAID performs real-time screenings of global watchlists along with PEP and sanctions lists and adverse media databases.

- Continuous Monitoring: Following verification completion the system actively checks for document expiration dates and emerging risks connected to the user.

Verification Process Explained (End-User Perspective)

For end-users the verification process maintains simplicity throughout its implementation.

- The verification process starts when users access the provided secure link or embedded form from the business.

- The platform leads users through every stage starting with data input and finishing with biometric scanning along with document submission.

- The verification system provides users with instant feedback about their verification status which promotes transparency.

- Users gain service access after completion verification and notification.

Admin Dashboard & Analytics Overview

The admin dashboard provided by KYCAID gives businesses complete control over verification management and monitoring functions.

- The case management section allows administrators to oversee verification cases by reviewing submitted documents and statuses.

- The admin dashboard provides verification metrics analysis which displays average processing times and pass/fail rates for performance evaluation.

- Businesses have the ability to configure verification workflows so they meet particular regulatory standards and risk assessment needs.

- The platform enables businesses to connect to existing systems through APIs and SDKs which ensure smooth operations.

Notifications & Reporting Mechanisms

KYCAID’s comprehensive notification and reporting tools support businesses in maintaining compliance and staying informed.

- Businesses receive instant alerts about verification problems or potential risks as soon as they appear during the process.

- Detailed reports produced by the platform help organizations fulfill legal requirements and prepare for audits.

- All verification activities are recorded in complete logs which foster accountability and transparency.

- Users receive automated notifications about their verification status along with required actions.

KYCAID’s verification process includes step-by-step instructions to deliver a secure and efficient system that users find easy to navigate. The platform provides multiple tools and features to help businesses meet compliance requirements while optimizing their operations.

Pricing and Cost Structure

KYCAID provides transparent pricing options that allow businesses of all sizes to find plans that meet their specific compliance requirements. The service offers both pay-as-you-go options and customizable enterprise plans which provide scalability while maintaining cost-effectiveness.

Pay-as-You-Go Verification Packages

KYCAID’s pay-as-you-go system enables businesses to pay exclusively for their used services without requiring subscriptions or any hidden costs. Startups and small to medium-sized enterprises achieve cost-effective compliance through this approach.

| Verification Type | Price (per verification) | Included Services |

|---|---|---|

| Document Verification | €0.50 | Name, Date of Birth, Nationality, MRZ code, Document Expiry Date, Forgery check, Document Number |

| Liveness & Face Match | €0.25 | Passive or Active Liveness check, Static selfie, Selfie with document, Selfie with credit card, Face-Match, Age Estimation, Liveness Snapshots, Video Recording |

| Assisted Video Verification | €1.00 | Video Chat with Agent, Video Recording, Speech-To-Text Transcription, ID Document verification, Liveness Verification |

| Database Screening | €0.10 | PEPs, Sanctions, Watchlist, OFAC Sanction Lists, Regulatory AML Watch Lists |

| Address Verification | €0.25 | Address extraction from document, Name match with ID Document, Automatic Address Validation |

| Tax Number Check | €0.10 | Tax number extraction, Tax number validation |

| Payment Method Verification | €0.25 | Bank card number extraction, Bank Statement Check, Name Matching, Fraud Check |

| Source of Funds Check | €0.50 | Source of income, Transaction amount, Annual income amount, Purpose of the transaction |

| Ongoing Monitoring | €100.00 (monthly) | AML Databases Monitoring, ID Document Expiration monitoring, Automatic Notification |

| Company Check (KYB) | €10.00 | Corporate documents check, Legal address, Business address, UBO check, Authorized person check |

| Mobile Number Verification | €0.25 | Phone Number Collection, Confirmation via SMS with OTP |

| Questionnaire | €0.05 | Multilingual option, Question types, Placeholder text customization, Question description, Validation text |

| Crypto Address Verification | €0.50 | Report, Risk score, Source of risk, Blacklists detection |

| Crypto Transaction Check | €0.50 | Report, Risk score, Source of risk, Transferred funds, Transaction sides |

*Source: KYCAID Pricing*

Predefined KYC Packages

For businesses seeking bundled services, KYCAID offers predefined KYC packages:

- Basic KYC: €0.60 per verification

- Includes Document Verification and Database Screening

- Advanced KYC: €0.85 per verification

- Includes Document Verification, Liveness & Face Match, and Database Screening.

- Pro KYC: €1.10 per verification

- Includes Document Verification, Liveness & Face Match, Database Screening, and Address Verification.

*Source: KYCAID Pricing*

Enterprise Plan

For organizations requiring high-volume verifications (starting from 10,000 per month), KYCAID offers a customizable Enterprise Plan. This plan provides:

- Exclusive pricing

- White labeling options

- Legal support

- Custom databases

- Dedicated account manager

- Change requests development

- Dedicated compliance team

- Data extraction from custom fields

Cost Transparency and Optimization

KYCAID maintains pricing transparency by eliminating all hidden fees. Businesses can use the platform’s Estimator tool to estimate costs according to their particular verification requirements. The pay-as-you-go payment structure enables companies to pay strictly for used services which facilitates efficient budget control.

KYCAID offers a flexible billing system that serves businesses of all sizes by delivering scalable compliance solutions at a cost-effective price.

KYCAID Customer Support & Resources

KYCAID delivers complete support services along with various tools to help companies achieve efficient KYC and AML compliance. The platform combines accessibility features with technical guidance and educational material to help clients use its services effectively.

Customer Support Availability & Quality

KYCAID operates 24/7 customer support accessible through email and phone communications as well as messaging applications such as Telegram and WhatsApp. Clients benefit from immediate support for their questions and problems due to the service’s continuous availability at all times.

Help Center and Knowledge Base

KYCAID Help Center provides centralized information about platform features and how to integrate and use them. The resource covers verification flow overviews and form settings alongside detailed breakdowns of verification steps. This tool assists users in learning how to maximize their utilization of KYCAID services.

Developer Documentation & API Guides

KYCAID provides detailed API documentation which supports developers in executing verification requests and managing responses for technical integration. KYCAID’s documentation covers authentication procedures and integration methods and provides test mode details to enable smooth integration of its services into current systems.

Training Resources & Webinars

The available information lacks specifics about training resources and webinars but shows that KYCAID’s customer support dedication and comprehensive Help Center offer clients access to necessary educational materials and guidance for their onboarding and compliance processes.

KYCAID delivers a powerful support framework along with numerous resources which businesses can utilize to meet compliance requirements and enhance their platform experience. KYCAID displays its commitment to customer success through continuous support availability coupled with extensive documentation and educational resources.

Security & Privacy

At beverified.org, we recognize that robust security and stringent privacy measures are fundamental when evaluating compliance platforms. KYCAID demonstrates a strong commitment to safeguarding client data through adherence to international standards and implementation of comprehensive data protection practices.

Data Security Standards & Certifications

KYCAID maintains high security standards in its industry through ISO certification and consistent security audits. These protective steps maintain a secure atmosphere for the platform’s sensitive information processing operations.

Data Storage & Privacy Policies

KYCAID follows the European Union’s General Data Protection Regulation (GDPR) guidelines to manage data processing activities. The organization serves as a data processor and occasionally as a data controller based on particular data processing requirements.

KYCAID’s Data Protection Policy demonstrates its dedication to responsible personal data management by processing information through lawful means while maintaining transparency and serving legitimate objectives.

Regulatory Compliance & Certifications Overview

KYCAID’s compliance framework meets international regulatory standards such as GDPR to protect personal data through meticulous handling and legal adherence. Following these standards demonstrates the platform’s commitment to protecting user data through privacy and security measures.

Audit and Transparency Reports

KYCAID implements periodic security assessments to evaluate and strengthen its data protection strategies. KYCAID keeps its audit reports confidential but uses these internal assessments to support its ongoing dedication to enhancing security and compliance operations.

KYCAID utilizes a security and privacy approach which integrates compliance with international standards and proactive data protection initiatives to create a complete strategy. The framework assures clients that sensitive data will be handled securely while complying with all necessary regulations.

Integrations and Compatibility

CRM & Business Tools Integration

KYCAID provides flexible integration methods to accommodate diverse business needs:

- API Integration: Allows for direct embedding of KYCAID’s verification processes into existing systems, offering full control over the user experience.

- Pre-set Verification Forms: Enables quick deployment of KYCAID’s services through customizable forms, reducing development time.

- Mobile SDK: Facilitates integration into mobile applications, ensuring a smooth verification process for end-users.

These integration options are designed to be implemented within a few hours to a couple of days, depending on the complexity of the client’s infrastructure.

Payment Gateway Compatibility

While specific payment gateway integrations are not detailed, KYCAID’s flexible API and SDK offerings suggest compatibility with various payment systems. This adaptability allows businesses to incorporate KYCAID’s verification processes into their payment workflows, enhancing security and compliance.

Integration with Blockchain & Cryptocurrency Platforms

KYCAID provides solutions specifically designed to address compliance requirements for blockchain and cryptocurrency platforms. KYCAID’s solutions enable crypto exchanges and digital asset services to implement KYC processes through decentralized identity verification without affecting user experience. The platform provides real-time fraud protection along with transaction monitoring and crypto address verification to maintain secure and compliant operations in the crypto ecosystem.

SDKs and APIs for Developers

KYCAID delivers comprehensive developer resources to streamline integration processes.

- API Documentation delivers extensive instructions for executing KYCAID’s services which cover authentication, error handling as well as verification workflows.

- Android SDK from KYCAID allows developers to implement KYCAID verification processes into Android apps while providing biometric verification and document scanning capabilities.

Available tools enable developers to integrate KYCAID’s solutions into their systems while preserving a smooth user experience.

KYCAID’s integration features allow companies to implement effective KYC and AML solutions across multiple platforms and industries by supplying necessary tools and flexibility. The full range of services provided by this company assists organizations with compliance while simultaneously boosting workflow effectiveness and user confidence.

Customer Reviews & Testimonials

As part of our comprehensive evaluation at beverified.org, we have analyzed available customer feedback on KYCAID to provide an objective overview of user experiences.

Overall Customer Sentiment

KYCAID has received a mix of reviews across various platforms. On ProvenExpert, it holds a perfect score of 5.0 out of 5, albeit based on a single review, highlighting its user-friendly platform and excellent customer support. Conversely, on Scamadviser, KYCAID has an average rating of 3.4 out of 5 from 32 reviews, indicating a range of user experiences.

Common Praises

- User-Friendly Interface: Users have appreciated KYCAID’s intuitive platform, which simplifies the identity verification process.

- Responsive Customer Support: The availability of 24/7 support through various channels like email, phone, and messaging apps has been noted positively by clients .

- Comprehensive Compliance Solutions: KYCAID’s all-in-one approach to KYC and AML compliance has been beneficial for businesses seeking streamlined verification processes.

Common Criticisms

- Limited Public Reviews: The scarcity of reviews on major platforms like Capterra and GetApp makes it challenging to gauge a broad user consensus.

- Mixed Feedback on Specific Use Cases: Some users have reported varied experiences, particularly in niche applications, suggesting that KYCAID’s performance may differ based on specific business needs.

Case Studies & Real-World Examples

While detailed case studies are not publicly available, KYCAID claims to serve over 100 companies across various industries, including fintech, healthcare, and e-commerce. This broad client base indicates a level of trust and adaptability in different business environments.

User Ratings on Third-Party Platforms

- ProvenExpert: 5.0/5.0 (based on 1 review)

- Scamadviser: 3.4/5.0 (based on 32 reviews)

- Capterra: No reviews available

- GetApp: No reviews available

KYCAID stands out as a potential solution for KYC and AML operations thanks to its straightforward interface and dependable support system. Potential clients need to perform detailed evaluations because the small number of public reviews does not provide sufficient information about whether the platform meets their particular needs.

Advantages & Disadvantages of KYCAID

As part of our ongoing review of compliance technologies, we’ve compiled a clear breakdown of the strengths and limitations of KYCAID based on factual data, verified features, and available user feedback. This unbiased summary is designed to help businesses assess whether KYCAID aligns with their operational and regulatory needs.

Benefits of Choosing KYCAID

- Flexible, Pay-as-You-Go Pricing

KYCAID offers one of the most transparent and modular pricing models in the KYC/AML space. Businesses can select and pay for only the services they need—ideal for startups and growing companies. - Comprehensive Compliance Coverage

KYCAID provides identity verification across more than 200 countries and processes over 10,000 document types while offering PEP/sanctions/adverse media screening to support global business operations. - Fast and User-Friendly Verification Flow

With options like passive and active liveness checks, video verification, and instant feedback, KYCAID simplifies the end-user experience without compromising security. - Versatile Integration Options

KYCAID supports API, SDK, and low-code/no-code forms integrations, which allow rapid deployment across mobile apps, web platforms, and CRM systems. - Dedicated Support and Customization

Enterprise users can access round-the-clock support through multiple channels while benefiting from specialized services including white-labeling options, KYB checks, and continuous AML monitoring. - Security and Compliance Assurance

The platform maintains GDPR compliance and holds ISO certification which gives businesses assured confidence in its data protection and audit procedures.

Potential Drawbacks & Limitations

- Limited Public Visibility and Reviews

The digital presence of KYCAID remains smaller than major KYC competitors like Jumio, Onfido, and Veriff since it lacks substantial public case studies and customer reviews which could affect risk-focused business decisions. - Lack of Built-in Analytics or Fraud Scoring Engine

KYCAID provides fundamental fraud prevention features but lacks detailed behavioral analytics and customizable fraud scoring models that some competitors deliver. - No In-Platform Payment Gateway Integrations Highlighted

Although the platform likely supports payment platform KYC needs, there’s limited information on direct integrations with major gateways (e.g., Stripe, PayPal), which might require extra development work. - Potential Overhead for High-Volume Use Without Enterprise Plan

Businesses conducting thousands of verifications monthly may need to negotiate custom plans to avoid scalability issues or cost inefficiencies.

Comparative Analysis: KYCAID vs. Competitors

| Feature/Provider | KYCAID | Jumio | Onfido | Veriff |

|---|---|---|---|---|

| Global Coverage | 200+ countries | 200+ | 195+ | 190+ |

| Pay-as-you-go pricing | ✅ Yes | ❌ No | ❌ No | ❌ No |

| Video Verification | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

| Mobile SDKs | ✅ Android | ✅ iOS/Android | ✅ iOS/Android | ✅ iOS/Android |

| PEP/Sanctions Monitoring | ✅ Included | ✅ Included | ✅ Optional | ✅ Optional |

| Public Reviews Volume | ⚠️ Low | ✅ High | ✅ High | ✅ Medium |

KYCAID stands out as the preferred choice for companies requiring a modular identity verification system that respects privacy laws and can operate on a global scale. The financial accessibility and adaptable integration capabilities together with its adherence to compliance standards make KYCAID especially attractive to SMBs and fintechs which operate in high-risk industries. Companies that require precise analytics or brand recognition should evaluate the potential trade-offs before choosing this option over more reputable brands.

Frequently Asked Questions (FAQs)

What documents does KYCAID accept?

KYCAID processes more than 10,000 different documents originating from 200 countries and territories. Accepted documents include:

- National ID cards

- Passports

- Driver’s licenses

- Residence permits

- KYCAID accepts utility bills and bank statements to verify addresses.

The platform utilizes AI-driven technology to identify and verify both the type of document and its country of origin.

How long does the verification process take?

Verification times vary depending on the complexity of the checks and the type of verification:

- Basic document + biometric verification: Often completed within 1–3 minutes

- Assisted video verification (with agent): May take up to 5–10 minutes

- KYB (business verification): May require up to 24–48 hours, depending on jurisdiction

KYCAID offers both automated and manual review processes to balance speed with compliance accuracy.

Is KYCAID suitable for small businesses?

Yes. The pay-as-you-go model from KYCAID provides startups and small-to-medium businesses with an attractive KYC/AML solution that doesn’t require high-volume contracts or enterprise licenses.

The business scaling process includes access to advanced features and enterprise support through the service when required.

Can KYCAID integrate with my existing systems?

Yes. KYCAID supports:

- RESTful API integration for full platform customization

- Mobile SDKs (e.g., Android SDK)

- Hosted verification forms for no-code/low-code setups

The adaptable nature of KYCAID enables it to work with CRMs, onboarding tools, mobile apps and back-office systems. Developers can access full documentation at docs.kycaid.com.

How secure is my customer’s data on KYCAID?

KYCAID follows GDPR guidelines, maintains ISO certification and encrypts customer data both during transmission and when stored to safeguard information.

KYCAID operates under GDPR compliance while maintaining ISO certification for data protection standards. The platform secures customer data through encryption during transfer and storage while performing regular internal reviews to maintain compliance with international security norms.

Conclusion & Final Verdict

Summary of Key Points

Over the course of our in-depth analysis, KYCAID has demonstrated itself to be a feature-rich and flexible KYC/AML compliance solution. Here’s what stands out:

- Comprehensive coverage across more than 200 countries and 10,000+ document types

- Flexible, transparent pricing models — including pay-as-you-go options

- Advanced verification features such as biometric checks, video calls with agents, crypto wallet risk scoring, and ongoing AML monitoring

- Strong regulatory alignment, with GDPR compliance and ISO certification

- Wide integration options, including APIs, SDKs, and low-code forms

- 24/7 multilingual support, extensive documentation, and developer resources

At the same time, KYCAID’s relatively low public visibility and lack of in-depth analytics or fraud scoring modules may be a limiting factor for enterprises seeking high-end features or third-party validation.

Recommendations: Who Should Consider KYCAID?

KYCAID is best suited for:

✅ Fintech startups and neobanks that need fast, compliant onboarding without massive upfront investment

✅ Crypto exchanges and DeFi platforms requiring wallet checks and PEP/sanctions screening

✅ SMEs and e-commerce platforms looking for modular identity checks

✅ High-risk industries (gaming, adult content, gambling, etc.) that require real-time fraud prevention and liveness detection

✅ Businesses with global operations thanks to KYCAID’s international document and language support

It may be less suitable for:

⚠️ Enterprises that demand behavioral analytics, AI fraud scoring, or integrations with established risk management suites

⚠️ Organizations that prioritize platforms with extensive case studies, industry recognition, or large-scale peer reviews

Final Thoughts & Next Steps

KYCAID has made significant strides in becoming a flexible, affordable, and regulation-aligned KYC/AML platform. Its modular structure, focus on usability, and depth of verification services make it a practical choice for businesses aiming to reduce fraud, maintain compliance, and improve user onboarding.

For those evaluating KYCAID, we recommend:

- Requesting a demo or test integration via their API documentation

- Estimating your needs via KYCAID’s pricing calculator

- Reviewing the Help Center and data protection policy to assess internal alignment

Ultimately, KYCAID represents a competitive and scalable option in the identity verification landscape — particularly for businesses that value flexibility, control, and global coverage.

Reviewed and fact-checked by the beverified.org compliance editorial team.