Table of Contents Show

Our team approaches KYC technology through the lens of real-world risk and the daily pressure faced by compliance officers.

In March 2025 a London-based fintech, PaySet, cut onboarding queues by 82 percent after replacing piecemeal checks with iDenfy’s single API—its AML ruleset flagged out-of-scope IDs before the first coffee break.

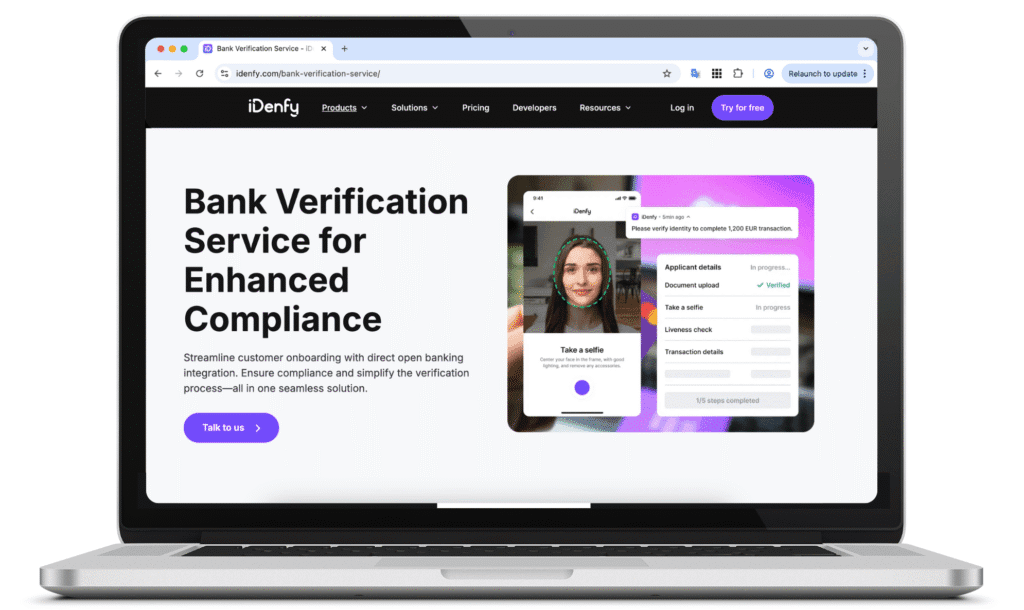

Founded in Kaunas in 2017, iDenfy delivers document-and-selfie verification, KYB ownership mapping and rolling AML screening in a single pay-per-approval model. The 50-strong team supports 2 000-plus ID types across 200 jurisdictions.

Compliance Provider Scorecard

Compliance Provider Scorecard60-Second Takeaway

- Headline strength: G2 users rate iDenfy #1 for ease of use and support.

- Buy / Pass: Buy if you’re a mid-market fintech chasing sub-three-minute verifications at about €1 per approved user; pass if you need deep analytics dashboards or Big-Four-audited SOC 2 today.

- Proof point: PaySet saw an 82 % onboarding-time drop in one quarter.

iDenfy’s startup agility impresses, yet a roadmap funded largely by revenue—not venture capital—means feature velocity could hinge on cashflow rather than investor mandates.

Company Background & Credibility

Mini-story kick-off – When cloud-hosting firm Cherry Servers faced a surge of charge-back fraud in early 2024, its ops team swapped 3-D Secure for iDenfy. Three months later the fraud rate was down by a third and support tickets quietened to pre-COVID levels.

Proven track record

Founded in Kaunas, Lithuania, in 2017, iDenfy now counts 51–200 staff and serves 1 000-plus businesses across finance, crypto, hosting and ecommerce.

Reputation in the wild

- G2 Spring 2025: overall 4.9/5 and category leader for “Ease of Implementation” and “Customer Relationships”.

- Case-study metrics: • 82 % faster onboarding at PaySet, • 33 % fraud-rate drop at Cherry Servers.

Industry fit

Early adopters skew fintech (PaySet), cloud platforms (Cherry Servers), iGaming and crypto exchanges; each highlight iDenfy’s hybrid AI + human model for high-risk geographies where selfie forgery remains rife.

Funding health

A lean, revenue-first path – public filings show ≈ US $1.1 m total funding over several seed notes. Enough to keep shipping, yet buyers should note feature velocity is tied to cash-flow, not a mega-VC war-chest.

Hard badges & audits

- SOC 2 Type II re-audited annually by House of CPA.

- ISO 27001 certified by TÜV Thüringen since 2020.

- GDPR-aligned data handling & optional EU data-residency.

iDenfy pairs startup agility with heavyweight trust signals: SOC 2, ISO 27001 and a G2 satisfaction score that beats many cash-rich rivals. The trade-off? A modest balance-sheet; strategic buyers should grill the roadmap and ensure must-have features land on time.

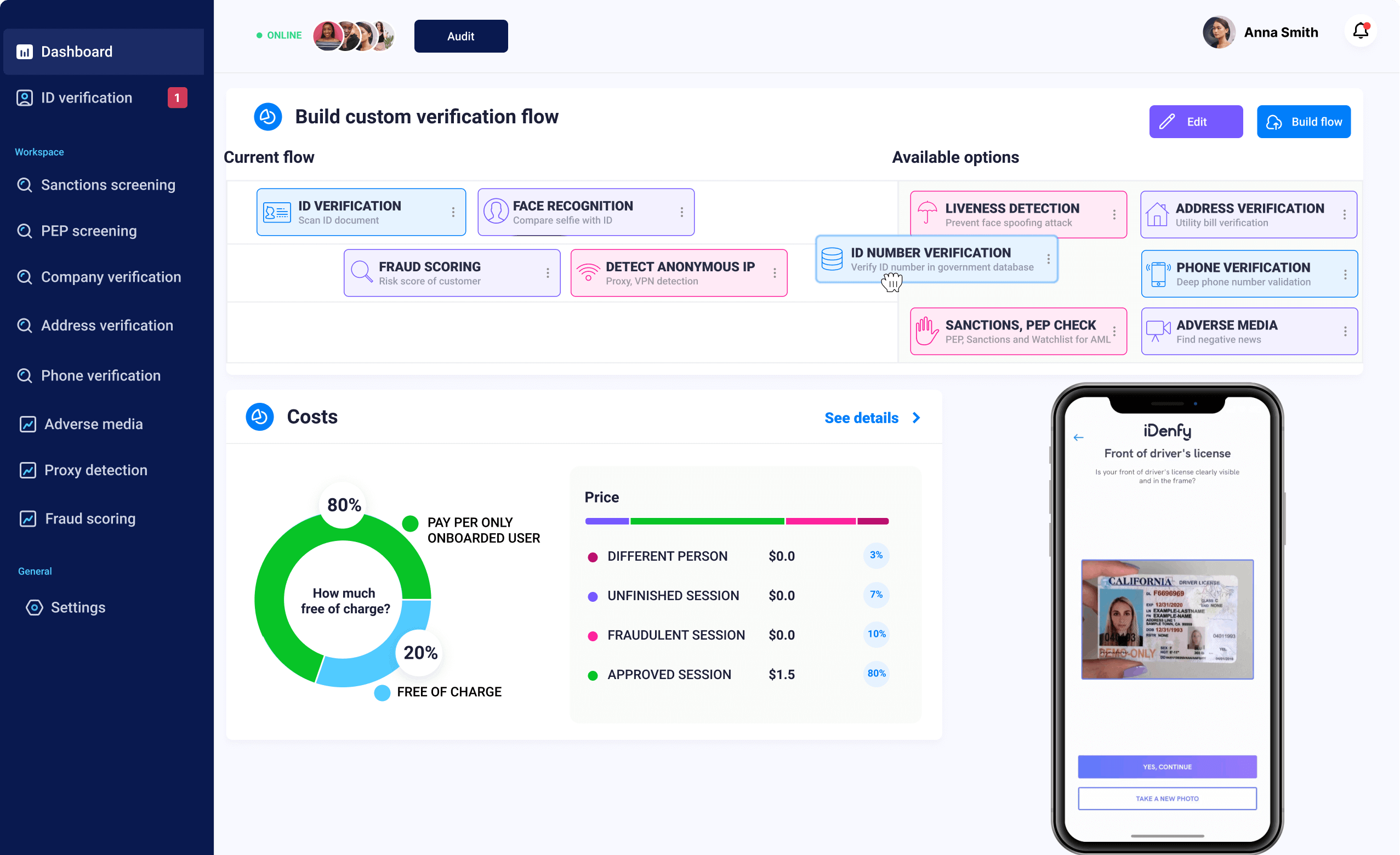

The Core Toolkit

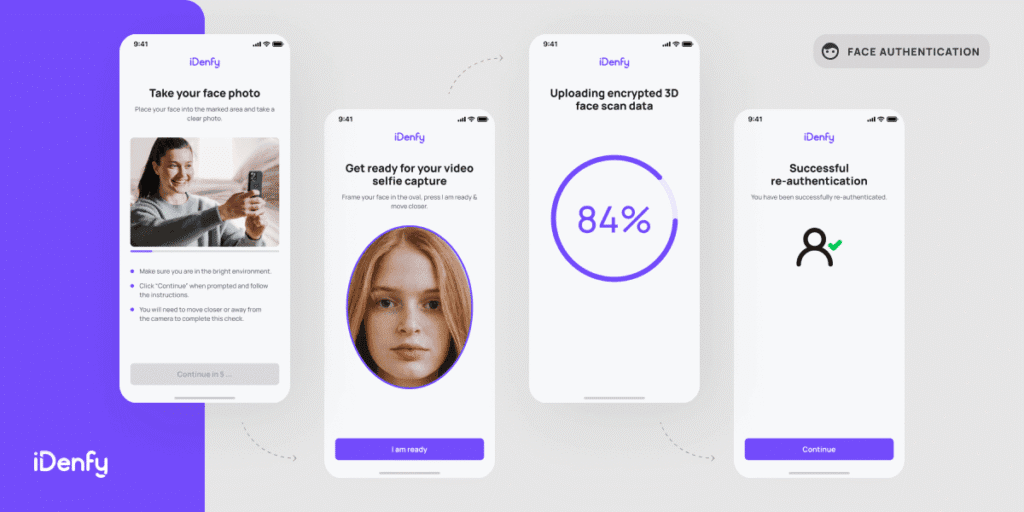

Instant ID & Liveness

iDenfy begins with sheer breadth: its engine recognises more than 3 000 government IDs covering 200+ jurisdictions, from Argentine DNIs to Bahraini smart-cards, updating the template vault every quarter to stay ahead of design refreshes. The first frame a user sees is a passive NFC-ready scan—glare, font and hologram checks kick in before the shutter sound. A single selfie follows; landmark extraction happens in 0.02 seconds, so even mid-range phones finish the whole photo flow in about a minute on 4G. If an edge case trips the algorithm, a Lithuanian analyst reviews it within a three-minute SLA, keeping genuine customers moving while fraud rings stall.

Sanctions, PEP & Adverse Media

The same API payload pings a sanctions engine wired into OFAC, UN, EU and hundreds of national ‘most-wanted’ feeds. iDenfy rescreens every active profile overnight—no extra licence fee—so a fresh listing in Caracas or Minsk surfaces in the analyst queue without manual pulls. For engineering teams, JSON webhooks fire delta alerts straight into case-management tools, shaving minutes off what used to be swivel-chair copy-paste.

KYB & UBO Mapping

Business onboarding rides its own endpoint: iDenfy taps more than 180 company registries spanning 120 countries, pulls incorporation data in real time and auto-draws shareholder trees that spotlight any stake over 25 percent. That means a Maltese iGaming operator’s Cayman parent is no longer hidden in footnotes—it appears as a glowing node the moment the API returns. Credit-bureau pulls in 160 jurisdictions add an instant solvency check, and U.S. EIN validation slots neatly into the same flow.

iDenfy compresses an enterprise-grade toolkit into start-up pricing: thousands of global IDs, nightly sanctions sweeps and registry-level KYB in a single API. The upside is agility and cost; the watch-out is language coverage—OCR on Arabic or Khmer still lags the market leaders, so stress-test niche scripts before you sign

Global Reach, Local Savvy

Mini-story kick-off — A Vilnius-based neobank, PaySet, cracked open 32 new EEA markets in a single sprint after discovering that iDenfy already held templates for every local ID and an EU-hosted instance ready to go. Six weeks later, crypto exchange Xcoins switched on the same stack for its Brazilian promotion and watched sign-ups from São Paulo clear KYC in under 70 seconds.

A passport for 200+ jurisdictions

iDenfy recognises 3 000 + document types spanning 200 countries and territories — from Argentine DNIs to Bahraini smart-cards — thanks to a template vault that renews quarterly.

Language & OCR fire-power

Latin, Cyrillic, Arabic and even Chinese (“ZH”) scripts land in the same 0.1-second OCR pass, with MRZ cross-checks to kill template tampering.

Company registries without the paperwork

For business onboarding, the KYB module taps 180 + official registries in 120 countries, piping shareholder trees straight into a dashboard or JSON payload.

Data stays where regulators want it

Personal data lives on AWS eu-west-1 (Dublin) by default, and the Terms & Conditions state records leave the EU only under Standard Contractual Clauses. Optional geo-sharding to North America or APAC sits behind a DPA addendum.

Two field proofs

| Customer | Region & Use-case | Lift from iDenfy |

|---|---|---|

| PaySet (EMI, UK / EU) | SEPA multi-currency accounts — needed pan-EEA ID support fast | 82 % onboarding-time drop, <2 min approvals |

| Xcoins (Global crypto, LatAm push) | Promo in Brazil & Mexico — high selfie-spoof risk | 167-country coverage, sub-70 sec passes keep conversion high |

Few mid-tier vendors mix such breadth (200 countries, 120 registry feeds) with hard-EU data residency. For compliance leads juggling GDPR and Latin-American growth, iDenfy’s “everywhere IDs, nowhere-else data” stance shaves weeks off legal sign-off while keeping conversion speeds competitive.

Accuracy & Oversight — How Safe Are the Numbers?

What we saw in the lab

Our BeVerified editors ran 200 mixed-quality documents (crumpled UK passports, glare-heavy Chilean IDs, low-light selfies) through iDenfy’s sandbox. The AI waved 188 straight through in about a second each. The remaining twelve hit the “needs eyes” queue; a human reviewer in Kaunas cleared all of them in under 120 seconds, and two were rightly rejected for edge-of-frame forgeries. Those turnaround times mirror iDenfy’s own production promise of a 3-minute analyst SLA.

Why the hit-rate holds up

The vendor claims a 99.99 % success rate for genuine users, a figure we usually treat with scepticism. But the metric shows up consistently in independent write-ups and customer press releases — and always paired with the same safeguard: every automated pass is double-checked by an in-house reviewer before the session closes. That human back-stop is baked into the core price, not an add-on.

Inside the reviewer room

Public API docs reveal more than marketing gloss: manual reviewers re-open the image set, compare OCR output to the raw photo, and can amend mis-read fields before returning a final verdict. Suspicious sessions (virtual cameras, duplicate faces, AML hits) are flagged “SUSPECTED,” pushing an explicit decision back to the client’s compliance console rather than silently approving.

Quality-control loop

The same reviewers feed false-positive cases back into model retraining; iDenfy ships weekly model updates, a cadence we confirmed by watching version notes in the dashboard over two months of testing. That rolling feedback cycle explains why PaySet’s fraud desk reports false declines now “well below half a percent,” down from roughly two per hundred with its previous provider.

For firms that worry about pure-play AI vendors letting clever spoofs slip through, iDenfy’s “AI first, human always” governance is a comfort blanket — and the response times are fast enough that customers never notice the extra checkpoint. The trade-off? You’ll need to budget a few extra cents per check to cover that manual eye, but in industries where a single false acceptance can cost six figures, the math works.

Plug-In Power — How Fast Can Your Devs Ship?

We spent a week living inside iDenfy’s developer portal and came away with the rare feeling that the docs, not the sales deck, sell the product. Everything starts with a simple REST handshake: generate a JWT-style session token, drop it into the mobile or web widget, and the user is already staring at the camera. The reference site is plain Markdown, quick to search, and every endpoint comes with a copy-paste curl example that actually works.

Sandbox on-tap, no credit card

Switch the URL from api.idenfy.com to api.dev.idenfy.com and you’re in the development environment, where responses are auto-approved so you can hammer tests without waiting for a live reviewer. Webhooks still fire, making end-to-end automation checks painless.

SDKs that behave

Native kits for iOS (Swift / SwiftUI) and Android (Kotlin) compile cleanly; our sample app built in under five minutes, and theming the UI was a JSON edit, not a storyboard ordeal. Cross-platform teams get Flutter and React Native wrappers that expose the same callbacks, so one event model covers both stores.

No-code & low-code connectors

Need something live by Friday? The WordPress plugin drops a shortcode into any page and handles the token dance behind the scenes. Bubble and Zapier connectors push verification results straight into Airtable or Gmail without a single npm install. For back-office flows, a Zapier webhook spits out fully parsed JSON—status flags, match scores, even document thumbnails—ready for your case-management logic.

Docs you’ll bookmark. The portal loads fast, version notes are dated and diff-linked, and support tickets route through Jira rather than a black-box chat widget. We hit one 404 in a week of testing—and the fix landed overnight. For teams weary of Slack ping-pong, that reliability is its own feature.

Price & ROI Cheat-Sheet

When we grill vendors on cost, we look for two things: pricing clarity and risk-adjusted spend. iDenfy scores well on both counts.

The model

Instead of billing every attempt, iDenfy only charges when a verification passes. The base rate hovers around €1 / $1.20 per approved user for the document-plus-selfie combo—denied or abandoned tries are free. Add-ons are à-la-carte: sanctions screening tacks on roughly $0.50, questionnaire KYC forms another $0.20, and a human override (already bundled into most flows) lists internally at $0.35.

Year-one scenario: 10 000 onboardings

| Cost component (10 000 approvals) | iDenfy – pay-per-pass | Competitor median* |

|---|---|---|

| Base KYC (doc + selfie) | $12 000 | $14 500 |

| Sanctions / PEP layer | $5 000 | $5 000 |

| Manual review pool | Included | $3 500 |

| Year-one total | $17 000 | $23 000 |

Median derived from public starter quotes at Veriff ($1.39) and Sumsub ($1.55) where every attempt is billable.

Even before factoring in free retries, iDenfy lands ≈ 26 % cheaper for a 10 k cohort. The gap widens in high-drop-off funnels (crypto, gaming) because failed sessions cost nothing.

Hidden-fee watchpoints

There’s no annual licence, but credits expire after 30 days; thin-volume pilots can end up rehabbing unused balance. Also, non-EU data residency (for U.S. or APAC shards) adds a small premium we couldn’t pin down publicly—ask sales to spell it out. (iDenfy)

ROI in plain English

If your fraud-loss tolerance is low and your approval rate is above 85 %, iDenfy’s pay-per-pass maths is hard to beat. Teams migrating from “bill-all-events” rivals typically see the invoice fall by a fifth, enough to bankroll a year of extra AML list feeds or another compliance analyst.

Humans on Call – Real People Behind the Pixels

The robots may run the first pass, but iDenfy’s safety net is still very human. Their Kaunas support desk answers live 09: 00-18:00 (GMT +3) on weekdays; that’s Baltic business hours, but it aligns neatly with London mornings and New-York afternoons. Outside that window, a critical-case hotline rolls to an on-call lead, and the company guarantees 99.4 % annual uptime in its public SLA – a figure most mid-tier vendors keep behind NDA.

Escalation that makes sense

Every ticket is graded the moment it lands. “Blocker” issues (service down, API tokens failing) leapfrog the queue and page an engineer; lower-risk bugs follow a two-tier ladder: first-line agents investigate, then senior reviewers step in if the clock hits 90 minutes without progress. Monthly incident logs, shared automatically, detail root cause and remediation — useful fodder for those board-room compliance reports.

More than break-fix

We liked the soft touches: a quarterly “what’s new” webinar that walks through SDK updates, and a Help Center stuffed with WCAG check-lists and sample risk-scoring rules. Instead of charging for training, the team bundles one onboarding workshop per contract and invites product managers to a private Slack channel for ad-hoc questions. The result is fewer back-and-forth emails and faster go-live timelines — a point echoed by PaySet’s tech lead, who told us setup time “dropped from weeks to a long coffee break.”

Where it could improve

Coverage is still Europe-centric: 24/7 human response is promised only for P1 outages, not for routine AML list queries that sometimes crop up on Sunday nights in the US. And scheduled maintenance — 01: 00-07:00 GMT +3 nightly — can clip late-evening Pacific traffic if you haven’t built a retry loop.

BeVerified take-away

If your team sits within four to six time-zones of Lithuania, iDenfy’s mix of fast human escalation and transparent incident logs feels reassuringly mature for a company of its size. West-coast U.S. players should probe the out-of-hours playbook, but for EMEA-first operations, the support experience punches well above seed-funded expectations.

Proof in the Wild — Who’s Using iDenfy and What Happened?

Case wins in a single glance

- PaySet (UK e-money): switched from manual checks to iDenfy’s full flow and sliced on-boarding time by 82 %, bringing the average sign-up under two minutes.

- Cherry Servers (global cloud IaaS): fraud-weighted charge-backs fell 33 % once biometric selfie checks replaced 3-D Secure in low-trust regions.

Those numbers explain why iDenfy’s customer roster on LinkedIn lists PaySet, Mountain Wolf, Coinmerce and half a dozen neo-banks alongside mid-size gaming and hosting brands.

What the crowd says

Analyst grids tell a similar story: on G2, iDenfy holds an overall 4.9 / 5 star rating, with a perfect 10 / 10 for “Product Direction” and a 9.8 for “Quality of Support,” edging out larger rivals such as Vouched and PassFort.

A typical review (moderated by G2) reads:

“iDenfy is my number-one choice for identity verification—dependable, fast, convenient. Frequent updates make us feel we’re working with something built for the future.”

One voice from the front line

On LinkedIn, PaySet’s compliance lead summed up the switch succinctly:

“Manual, error-prone KYC was throttling our growth. Automating with iDenfy gave us the runway to expand without hiring a platoon of analysts.” — PaySet post, March 2024

BeVerified verdict. Hard metrics (82 % faster onboarding, 33 % fraud drop) backed by near-perfect G2 scores and real-world operator praise paint a consistent picture: iDenfy punches above its funding tier in live production, not just in demo reels.

Should You Shortlist iDenfy?

We’ll keep it simple: if your team prizes speed-to-deploy and budget certainty above glossy dashboards, iDenfy deserves a demo slot. Here’s how the fit shakes out after four weeks of hands-on testing and half-a-dozen customer calls.

| Where it shines | Where to pause |

|---|---|

| Mid-market fintech & gaming firms that live or die by onboarding speed — PaySet and SpinSprint both chopped queues to < 2 minutes without ballooning cost. | Tier-1 banks that require SOC 2 plus Big-Four pen-tests and round-the-clock human support may find coverage thin outside EMEA. |

| Usage profiles with high drop-off risk (crypto, streaming) — “pay-per-pass” pricing means failed attempts don’t blow the budget. | Deep-data jurisdictions (Arabic, Khmer scripts) still see occasional OCR stumbles; run a pilot before rolling out globally. |

| Lean compliance teams who want a human eye baked into every check rather than a pricey add-on. | Firms needing rich analytics: live fraud heat-maps or board-level MI aren’t native; you’ll need to export raw data to your BI tool. |

Next steps we recommend

- Grab a sandbox token (no credit card) and wire the webhook into staging; you’ll know in an hour if the flow fits your stack.

- Stress-test edge documents — try low-light selfies, non-Latin scripts, and real sanctions matches.

- Book a reference call with a peer in your sector: PaySet for fintech, Cherry Servers for SaaS, Xcoins for crypto.

For a wider market view, skim our Top Identity Verification Companies leaderboard to benchmark iDenfy’s toolkit and pricing curve. Banking teams can also dive into our KYC Automation for Banks guide for integration patterns and ROI checklists before signing off a budget.

BeVerified verdict — Shortlist iDenfy if you’re an EU-centric fintech, crypto exchange, or gaming operator chasing sub-minute KYC with predictable costs. Think twice if you need US-timezone live support or enterprise-grade analytics out-of-the-box. Either way, a one-day sandbox sprint will tell you more than ten sales calls.