Table of Contents Show

Financial crime progresses at a rapid pace while conventional compliance methods frequently fall behind. Illicit operations including money laundering and human trafficking along with sanctions evasion and political corruption show increased levels of sophistication and media exposure in today’s global environment.

Adverse Media Screening (AMS) which is also called Negative News Screening (NNS) has moved from being optional to absolutely essential. Every contemporary anti-money laundering (AML) strategy must include it as an essential element.

What is Adverse Media Screening?

Adverse Media Screening (AMS) examines public sources like reputable news sites and court records together with blogs and social media platforms to identify negative references about individuals or organizations.

AMS improves standard KYC and KYB processes through the identification of reputational and regulatory risks that have not yet been included in official watchlists.

But context is key. The impact of criminal connections outweighs the significance of negative restaurant feedback. Successful AMS tools target media coverage which relates to AML red flag indicators such as:

- Financial crimes – money laundering, embezzlement, insider trading

- Sanctions violations include financial dealings with sanctioned countries and disguised corporate entities.

- Exposure to organized crime and terrorism includes connections with criminal networks along with politically exposed persons (PEPs) and their related actors.

- AMS tools focus on media related to AML red flags which include enforcement actions against regulatory breaches along with fraud investigations and audit failures.

AI-powered AMS solutions enhance traditional methods by minimizing false positives and boosting signal accuracy while delivering real-time contextual risk evaluations.

The Risk of Ignoring Adverse Media

1. The Data Overload

The amount of data available has reached unprecedented levels while criminals have developed techniques to manipulate it. Malicious actors exploit fake news along with spoofed identities and fragmented reporting to maintain their anonymity. Manual monitoring fails to track rapid threats effectively when they cross international borders and different legal territories.

2. The Regulatory Pressure

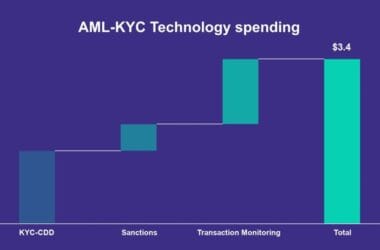

Global regulators have ceased waiting for institutions to reach compliance levels. FATF alongside the EU AML Authority and FinCEN have pushed financial institutions towards widespread adoption of advanced compliance tools such as AMS.

Failure to act comes with steep costs:

- Tier 1 banks face billions in fines for non-compliance.

- Reputational damage that’s hard to undo

- Regulatory blacklisting or greylisting

- Potential legal liability for executives

AMS functions as an essential component of your anti-money laundering protection strategy.

Smarter AMS Starts with Automation

Modern compliance teams need to move away from manual media processing to remain effective. Automation and AI-powered AMS systems take the lead because they outperform manual methods.

🔍 Contextual Risk Analysis

Articles using the term “fraud” should not receive equal consideration. AI-powered AMS evaluates tone and source credibility along with its relation to other risk factors which creates more targeted insights.

🔄 Real-Time Monitoring

The real-time scanning of thousands of sources offers accelerated detection for emerging risk events which include new sanctions or corruption scandals and regulatory fines.

🤖 KYC/KYB Integration

The automated AMS system integrates with client risk assessment tools during onboarding which helps identify high-risk entities before they join your system.

❌ Fewer False Positives

Eliminate wasted effort and concentrate investigations on essential areas. Intelligent algorithms minimize background noise while increasing visibility for essential risks.

📹 Enhanced Identity Verification

AMS uses video KYC and AI-powered facial recognition technology to authenticate customer identities in both high-risk areas and remote locations.

The Future of AMS is Predictive

AMS solutions are evolving quickly. We’re entering an era of:

- Predictive risk scoring identifies potential threats before they occur.

- Deepfake detection to prevent misinformation attacks

- UBO mapping tools reveal the true beneficial owners hiding within intricate corporate networks.

These tools protect both institutions and their customers from increasing financial crime threats rather than merely fulfilling compliance requirements.

Final Word

Criminals are getting smarter. Regulators are moving faster. And the headlines often arrive too late.

Automated Adverse Media Screening serves as your primary line of defense. This system shifts organizations from reactive compliance responses to proactive risk prevention approaches. We at Be Verified consider AMS to be not just a regulatory necessity but also a strategic protection for today’s global financial environment.