Table of Contents Show

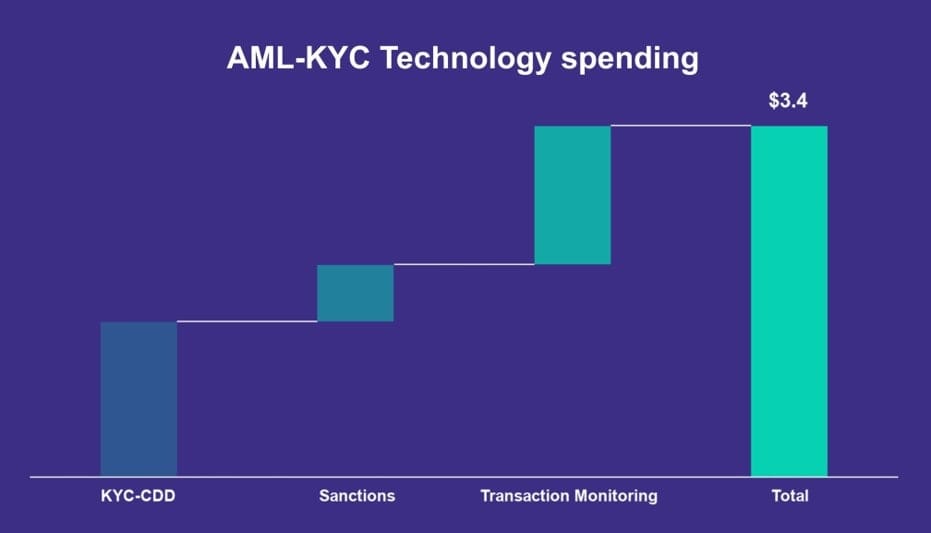

Worldwide spending on anti-money laundering (AML) and Know Your Customer (KYC) systems will reach $2.9 billion in 2025, a 12 percent increase over last year and more than double 2021 levels, new data show. Figures from Burton-Taylor International Consulting imply that long-promised artificial intelligence savings in compliance are for the moment still mostly hypothetical

AI: A Cost Saver — Just Not Yet

Banks are sinking costs into new tools that claim to speed up screening and risk scoring, but many of those same tools are fueling near-term expenses. AI models have to be trained, married to legacy platforms and kept up-to-date with local data-privacy regulations. Smaller firms in particular are beginning to feel the squeeze.

“AI isn’t always as smooth and straightforward as promoters suggest,” the report notes.

Deepfake technology has already added complexity to customer onboarding, for example, forcing institutions to add investment in more robust biometric and liveness-detection checks. That extra layer of defence now sits on top of already expensive due-diligence systems.

Regional Breakdown: The Americas Lead, EMEA Grows Fastest

The Americas hold the biggest market share for compliance spending. Experts predict this will be $1.45 billion in 2025. EMEA is not far behind at a little over $1 billion with a nearly 16 percent increase. The Asia Pacific region is at approximately $388 million.

Analysts from Burton-Taylor attribute much of this growth to tech enhancements. Real-time screening, machine-learning models for risk scoring, and the building of internal AI platforms to avoid depending on third-party generative AI tools all play a part.

GenAI and the Privacy Dilemma

Banks are wary of plugging customer data into large-language-model platforms such as ChatGPT while data-protection laws remain murky. Many are developing private, in-house GenAI networks or licensing closed-loop versions from vendors that keep personal data on the banks’ servers.

These efforts can cost into the tens of millions, particularly once cybersecurity and regulatory reviews are factored in.

Regulation: A Moving Target

Burton-Taylor associates much of the new spending with the speed of rule-making. Updates on sanctions, crypto regulation or environmental-crime enforcement come every quarter. Sanctions have grown more expansive since Russia’s invasion of Ukraine, for example, with entire sectors now subject to screening.

The cost of non-compliance also continues to mount. In 2024, TD Bank agreed to pay $3.2 billion to resolve U.S. AML-related claims, three-quarters of all fines in North America for the year. “Reputations built over decades can be devastated by a single compliance incident that goes viral,” the report says.

The Vendors in Front

An AI arms race is transforming the vendor landscape.

- LexisNexis Risk Solutions is at the top with an estimated revenue of $914 million (32 percent market share).

- The London Stock Exchange Group—owner of Refinitiv—follows with $852 million (30 percent).

- Moody’s and Dow Jones Risk & Compliance each have about 13 percent, while smaller players including Dun & Bradstreet, ComplyAdvantage, and Acuris share the rest.

These companies are widening their focus from watch-list screening to perpetual KYC, AI-driven transaction monitoring, and digital onboarding. See our independent AML software provider reviews for performance comparisons.

What “Perpetual KYC” Actually Changes

Periodic KYC is replaced by customer data that are monitored perpetually. Rather than a KYC re-check every 3-5 years, AI models are identifying risk exposure changes in real time. Less manual reviews mean lower friction and more accuracy—but after the required upfront integration lift.

Burton-Taylor calls this the “new normal”: more short-term spend, less long-term friction.

Takeaway for Compliance Leaders

AI is changing the game in compliance, but it’s not cheap. $3B signals a system in flux: Banks paying now for automation that will (eventually) reduce both cost and risk.

Expect more data science hiring, closer vendor scrutiny and increased regulatory pressure until integration is more mature.