Table of Contents Show

Know-Your-Business checks used to be a postcard from the past—a single snapshot taken at onboarding, filed away, then revisited when auditors circled back. That rhythm feels quaint in 2025. Directors resign overnight, shell companies switch hands before breakfast and sanctions lists refresh while you pour coffee. Perpetual KYB treats due diligence as a 24-hour news ticker. It pairs registry feeds, sanctions lists and open-source intelligence with algorithms that match every fresh data point to the right customer, raising a flag the moment risk changes.

This guide explains what perpetual KYB is, why regulators nudge firms toward it, and how to weave it into daily operations without drowning staff in alerts. It leans on public guidance from FATF, FinCEN and the EU—but also on field notes from banks and fintechs that already run continuous monitoring at scale. The result is a playbook you can bring to your next compliance meeting and translate into code the same week.

What Perpetual KYB Means

Think of traditional KYB as a still photograph: crisp at the moment you hit the shutter, blurry as soon as the subject moves. Perpetual KYB is live video. Instead of waiting a quarter or a year to ask, “Has anything changed?” the system watches official filings, corporate-registry APIs, beneficial-owner databases, sanctions updates, court dockets and real-time news. Each incoming item is run through entity-resolution logic. If it matches a customer, the platform updates the profile, adjusts the risk score and decides—by rule or machine-learning model—whether to alert a human.

The mechanics are simple but potent:

- Ingestion. API calls, webhooks or daily flat-file drops pull raw data.

- Normalization. Names, registration numbers and addresses are cleaned and standardized.

- Matching. Fuzzy logic links “ACME Holdings BV” to “Acme Holdings B.V.” across jurisdictions.

- Scoring. Rules or models weigh the change: new director + sanctioned hit = high; postcode change alone = low.

- Action. High-risk events open a ticket, update the CRM and—if policy dictates—suspend the account pending review.

The loop runs continually, using tricks borrowed from streaming data platforms. A registrar in Estonia issues a filing at 02:14 UTC; by 02:15 the update is indexed, matched and queued. Analysts start their shift with fresh context, not stale profiles.

Why It Matters

Regulatory gravity. The Financial Action Task Force (FATF) embeds “ongoing due diligence” in Recommendation 10. The EU’s 5th and 6th AML Directives require firms to verify and keep verifying beneficial-owner data. In the United States, FinCEN’s Customer Due Diligence Rule obliges banks to “update when risk dictates.” Supervisors rarely spell out the cadence; they simply expect you to know material changes in near real time.

Risk moves faster than calendars. In 2022, a northern-European bank learned a key customer had been sanctioned four months earlier. The delay cost €90 million in penalties and remediation. Perpetual KYB narrows that window from months to minutes, making it harder for high-risk actors to hide inside stale files.

Cost discipline. A 2024 Oliver Wyman survey found large banks spend 30–40 percent of their financial-crime budget on periodic file refresh. Firms that automated KYB updates cut those costs by half over two years, mostly by avoiding the quarterly “all-hands” remediation sprint.

Operational relief. Continuous monitoring lowers analyst burnout. Instead of wading through 5 000 files every December, teams process micro-alerts daily—a few minutes here, a deeper dive there. Work spreads evenly, knowledge stays current and surprises fade.

Inside a Perpetual KYB Engine

- Data Intake. Pulls from corporate registries (UK Companies House, Delaware, Singapore BizFile), UBO registers, sanctions & PEP lists, court databases, credit bureaus and adverse-media feeds.

- Entity Resolution. Combines deterministic keys (registration numbers) with probabilistic matching (fuzzy names + address + date incorporated). Good engines push accuracy above 95 percent while keeping false hits low.

- Business Rules. An if-then layer: if new director AND director on OFAC, then escalate; if company status changes to “struck off,” auto-suspend account.

- Machine-Learning Overlay. Models learn which alerts matter by analyzing past analyst decisions, gradually suppressing noise without hiding edge-case risk.

- Alert Distribution. Critical events post to a case-management queue with full context. Low-level updates auto-file into the audit log.

- Audit Trail. Every decision—auto or human—writes back to the customer file, creating regulator-ready evidence.

The Rulebook

FATF. Recommendation 10’s footnote is blunt: firms must conduct ongoing monitoring “throughout the course of the business relationship.” Supervisors interpret “ongoing” as near real-time for high-risk sectors, at least weekly for the rest.

EU AMLD 5 & 6. Both directives mandate updated UBO data and risk-based review cycles. Several member-state regulators (BaFin, CSSF, ACPR) now ask firms to demonstrate how they keep files current—usually by pointing to continuous-monitoring logs.

FinCEN / Corporate Transparency Act. FinCEN’s CDD Rule doesn’t impose a calendar but expects “trigger-driven” updates. The CTA’s beneficial-owner database, coming fully online in 2025, will offer U.S. institutions a real-time source to reconcile against clients. Banks without automated KYB will struggle to ingest that feed manually.

UK Economic Crime Act 2022. Imposes stricter filing deadlines and harsher penalties for wrong corporate data. The trend line is clear: regulators want stale files gone.

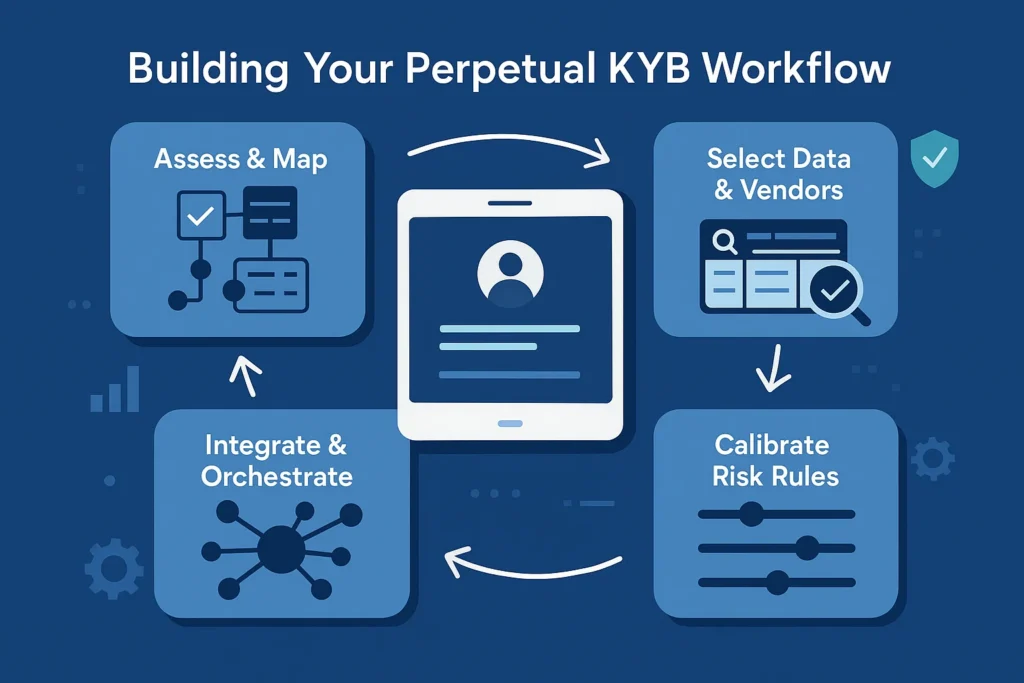

Building Your Perpetual KYB Workflow

Assess & Map

List current KYB touchpoints: onboarding, periodic review, trigger events. Document which data sources, systems and teams own each step. Mapping shows where automation plugs in.

Select Data & Vendors

Compare registry coverage, update latency, sanctions sources and API terms. Questions to ask:

- Do you cover private registries in high-risk jurisdictions (e.g., BVI, Seychelles)?

- How quickly after a filing do you surface it? (Aim for <24 hours on major registries.)

- Can we pass beneficial-owner IDs for live KYC on the persons behind the business?

Integrate & Orchestrate

Feed customer IDs from the CRM or core banking platform into the monitoring engine. Many tools offer a nightly “watchlist” push via SFTP or a streaming API. Connect the alert output to your case-management system (ServiceNow, Actimize, proprietary). Avoid swivel-chair by embedding links directly back to the customer profile.

Calibrate Risk Rules

Start conservative: treat every registry change as an alert; accept some noise. After a month, review outcomes. Suppress events that never matter (e.g., cosmetic address formatting), elevate those that do (e.g., new controlling shareholder in a high-risk jurisdiction). Good teams revisit rules quarterly.

Pilot & Rollout

Pilot on a defined segment—say, fintech clients onboarded in the last six months. Measure alert volume, false-positive rate, analyst time per alert. When metrics stabilize, scale in concentric circles to the full customer base.

Monitor & Improve

Track metrics (false-positive rate, mean time to disposition, percentage of alerts auto-cleared). Feed analyst feedback back into matching and ML thresholds. The engine should grow quieter and more accurate over time.

Best Practices & Common Pitfalls

- Tie refresh rates to risk tiers. High-risk: live feeds. Medium: daily incremental updates. Low: weekly batch. Regulators care that your policy matches your risk appetite.

- Invest in data hygiene early. Duplicate IDs, nickname spellings and missing company numbers produce 60 percent of false positives in most pilots.

- Guard against alert fatigue. If humans close 90 percent of alerts as “not relevant,” tweak thresholds. Machine-learning models can cut false positives by 50 percent after eight weeks of feedback.

- Log every decision. A two-line note—“Alert closed. Director match false: DOB mismatch.”—beats a scramble during an audit.

- Review your playbook quarterly. New registries open APIs, sanctions programs expand, crypto wallets appear on blacklists. Static rules age fast.

pKYB Providers

Below, three providers illustrate different takes on perpetual KYB. Order is illustrative, not prescriptive.

- KYCAID — Focus on SME affordability. Onboards a business in minutes via document OCR, then sets “heartbeat” monitoring across registries, sanctions lists and document expiry. Users get an “at-risk” banner if a director’s ID scans as expired.

- iDenfy — Heavy on breadth. Pulls filings from 180 registries, overlays AI matching and streams events to clients via webhook. A dedicated “PEP Radar” rescreens directors and UBOs daily without manual input.

- FullCircl — API-first. Treats company data as a streaming service. Director resigns? Alert appears in Salesforce within seconds, complete with context cards. Their ROI pitch: cut analyst hours on annual reviews by 80 percent.

For a broader directory of KYB vendors, visit beverified.org/providers/kyb/.

Implementation Roadmap (Cheat-Sheet)

- Month 1 — Discovery. Map data flows and pick a pilot customer segment.

- Month 2 — Vendor RFP. Score candidates on coverage, latency, API fit, security and price.

- Month 3 — MVP Integration. Build APIs / SFTP links. Ship first test alerts to your sandbox case-manager.

- Month 4 — Tuning. Collect 30 days of alerts. Meet weekly to tweak thresholds.

- Month 5 — Go Live. Flip monitoring to production for pilot book.

- Month 6–9 — Scale. Roll to broader portfolios. Add new data feeds (credit, adverse media, crypto risk).

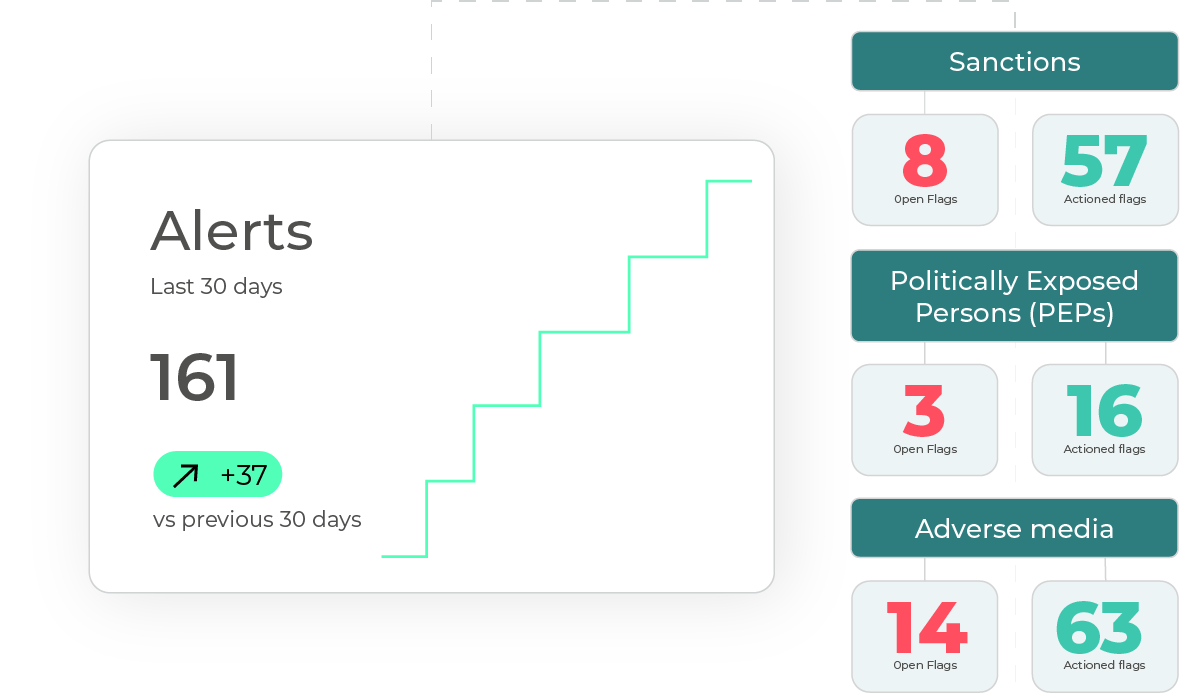

Metrics That Matter

- Alert-to-Customer Ratio. Ideal: 0.1–0.3 per customer per month.

- False-Positive Rate. Target <40 percent by month three, <20 percent by month six.

- Mean Time to Disposition (MTTD). Count hours from alert raise to analyst close. Sub-24 hours earns audit praise.

- Coverage Gap. Percentage of customers unmonitored for more than policy-approved duration. Goal: 0 percent.

- Cost per Alert. Analyst minutes × wage. Track down as ML tuning improves.

Frequently Asked Questions

Is perpetual KYB legally required?

Laws rarely say “perpetual,” but regulators insist on “ongoing monitoring.” Continuous engines are the surest way to show you meet that bar.

How often should the data refresh?

Let risk be the metronome: real-time for high-risk, daily for medium, weekly for low. Document the logic in your policy.

What changes trigger an alert?

Common triggers: new directors or shareholders, company status downgraded (e.g., “strike-off pending”), sanctions/PEP hits, adverse media, large credit-score swings, or transaction behaviour outside the ordinary.

Will automation raise or cut costs?

Initial spend rises (software, integration), but periodic-review costs fall sharply. A mid-tier bank piloting continuous monitoring cut analyst hours on KYC refresh by 55 percent within 18 months.

Who beyond banks uses pKYB?

Crypto exchanges, B2B marketplaces, supply-chain networks and insurers deploy continuous KYB to keep fraud and reputational risk in check.

Perpetual KYB isn’t a buzzword; it’s the new baseline for business verification. It shrinks blind spots, keeps regulators satisfied and frees teams from calendar-driven fire drills. Whether you bolt on a vendor API or build an engine in-house, the goal is the same: a living customer profile that updates as fast as risk itself. In a world where misconduct moves at network speed, your KYB has to move faster.